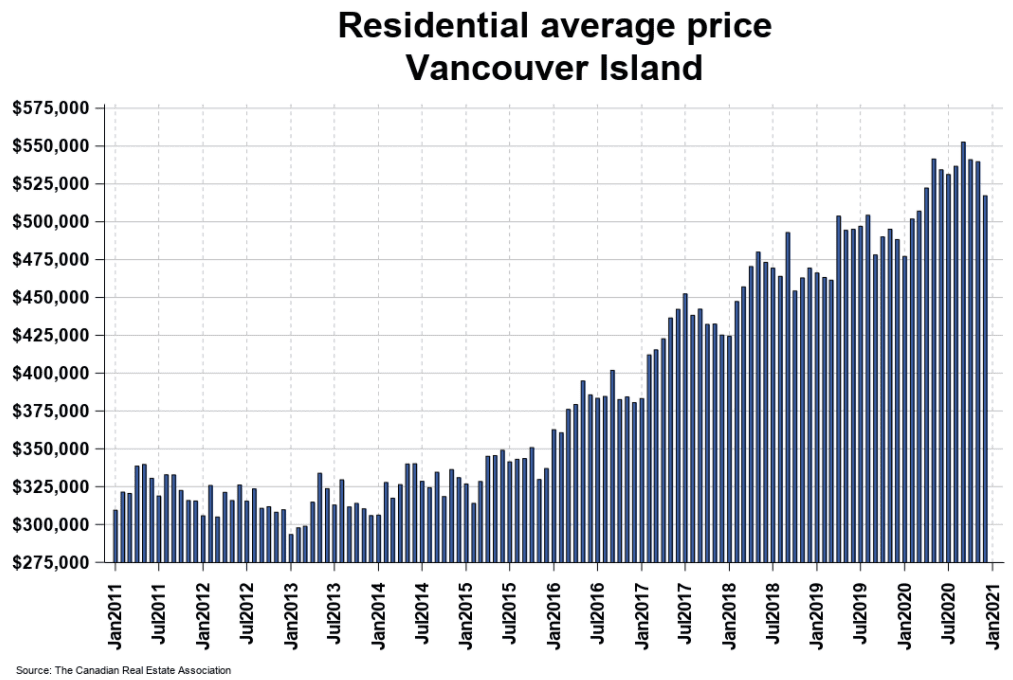

In my opinion, Real Estate market is a direct correlation to inflation as property is an asset and there is a finite amount of it available. Google the recommended investments to make when hedging against inflation, you will see REIT (Real Estate Investment Trust) up at the top. As an owner buying Real Estate as an investment, rent can increase. When there is inflation, money decreases in value but rents increase. However the main factor by far is supply and demand, real estate’s values keeping with inflation, due to homes and land being a limited resource. This puts upward pressure on your homes’ value. Keep in mind, we can see shifts as quickly the other way so it is important to monitor factors influencing our supply and demand as well as the overall economy.

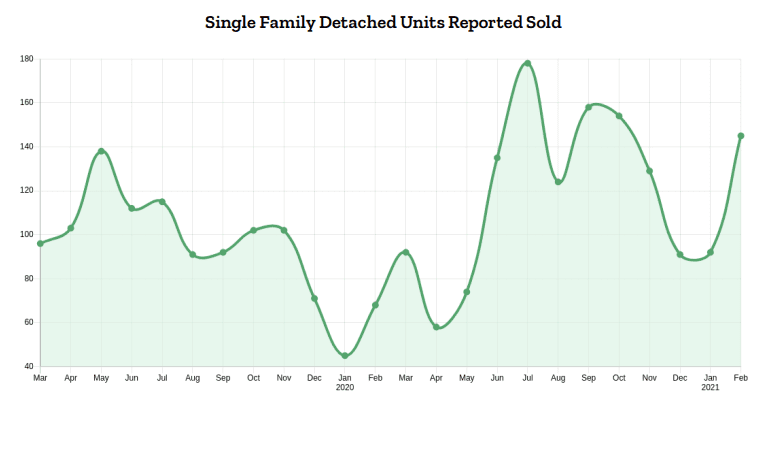

This brings us to our Real Estate market. Active listings of single-family detached properties dropped to 394 in February. There were 169 condo apartments for sale last month compared to 212 in January, a drop of 20 per cent. Last month, 417 single-family detached properties sold on the MLS® System, a year-over-year increase of 56 per cent.

In the condo apartment category, sales rose by 132 per cent year over year, while row/townhouse sales increased by 42 per cent .

This can frustrate buyers. The demand is there, but there is not enough listings to satisfy it. Our federal and provincial governments tend to focus on demand-side policies instead of addressing the supply issue. The run to higher Real Estate Taxes or strict financing measures rather than addressing or helping the actual housing shortage. The British Columbia Real Estate Association (BCREA) does not see the inventory situation improving until more supply comes online hopefully later in the year, the length of time it takes to get a development off the ground is causing parts of the issues as we are becoming an increasingly popular destination to live for buyers of all ages. With the shifts we saw in working from home possibilities, there are younger buyers that now look to move here than in the past.

Negative international immigration has overshadowed gains due to inter-provincial migration, resulting in a net decrease of 3,055 people to British Columbia’s population in the third quarter of 2020. This was a stark reversal of the gain of more than 30,000 people in the previous third quarter and stood as the largest net loss on record.

Changes in population from movement within Canada: Some 13,460 people moved to British Columbia from other provinces in the third quarter of 2020. This was down 10% from a year earlier. Fewer people came to British Columbia from Alberta and Ontario compared to a year earlier.

A total of 8,718 people left the province for elsewhere in Canada in the third quarter, a decrease of 31.7% from the same period in 2019. Fewer people leaving for Alberta and Ontario accounted for most of this decline.

The result was a net gain of 4,742 people to British Columbia’s population in the third quarter. This was an increase of 115.7% from the third quarter of 2019.

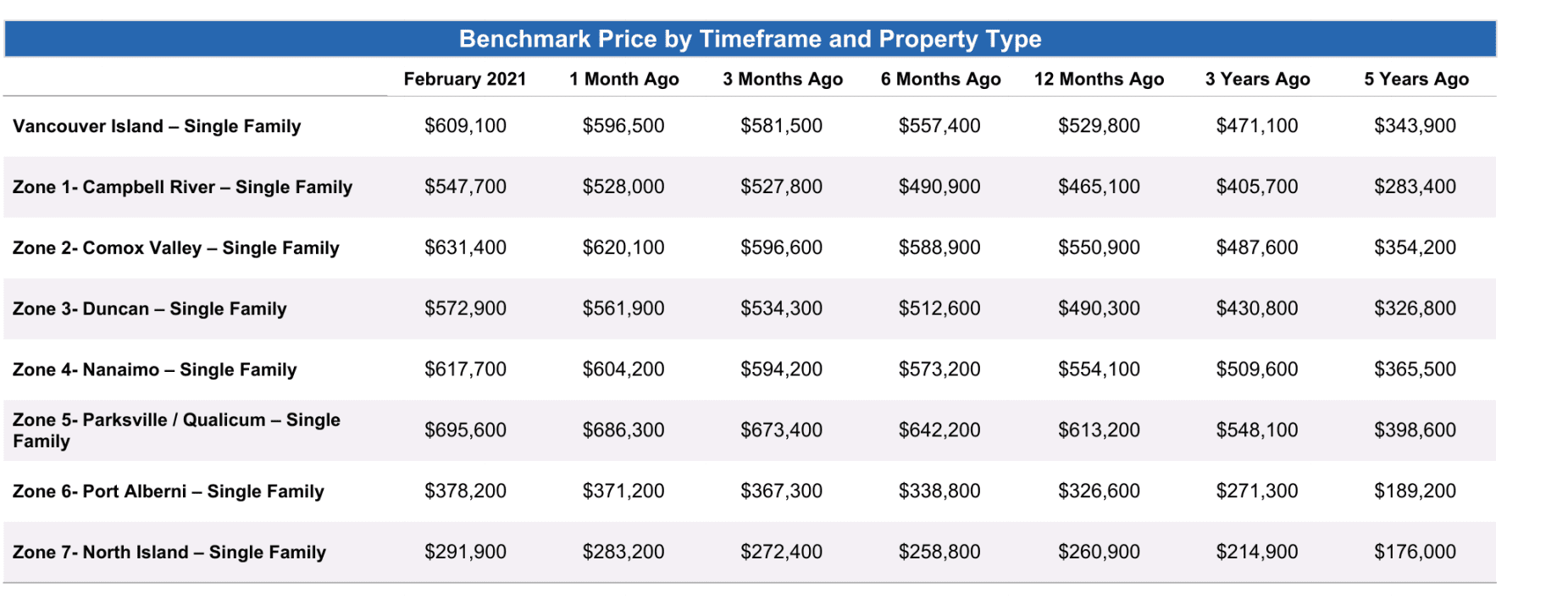

Local market snapshot:

Campbell River, the benchmark price of a single-family home hit $547,700 up 18 per cent over last year.

Comox Valley, the benchmark price was $631,400, up by 15 per cent from one year ago.

Duncan reported a benchmark price of $572,900, an increase of 17 per cent from February 2020.

Parksville-Qualicum area saw its benchmark price increase by 13 per cent to $695,600.

Port Alberni reached $378,200, a 16 per cent year-over-year increase.

For the North Island, the benchmark price rose to $291,900, a 12 per cent increase over last year.

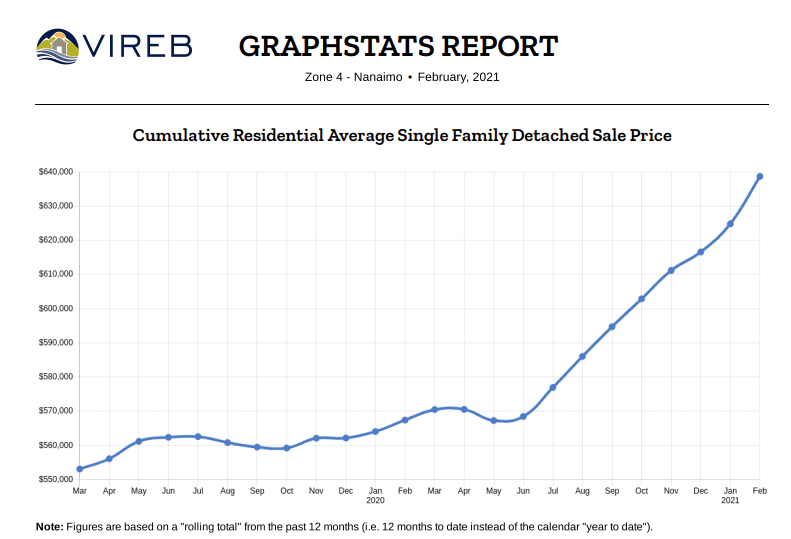

Nanaimo’s benchmark price rose by 12 per cent, hitting $617,700.

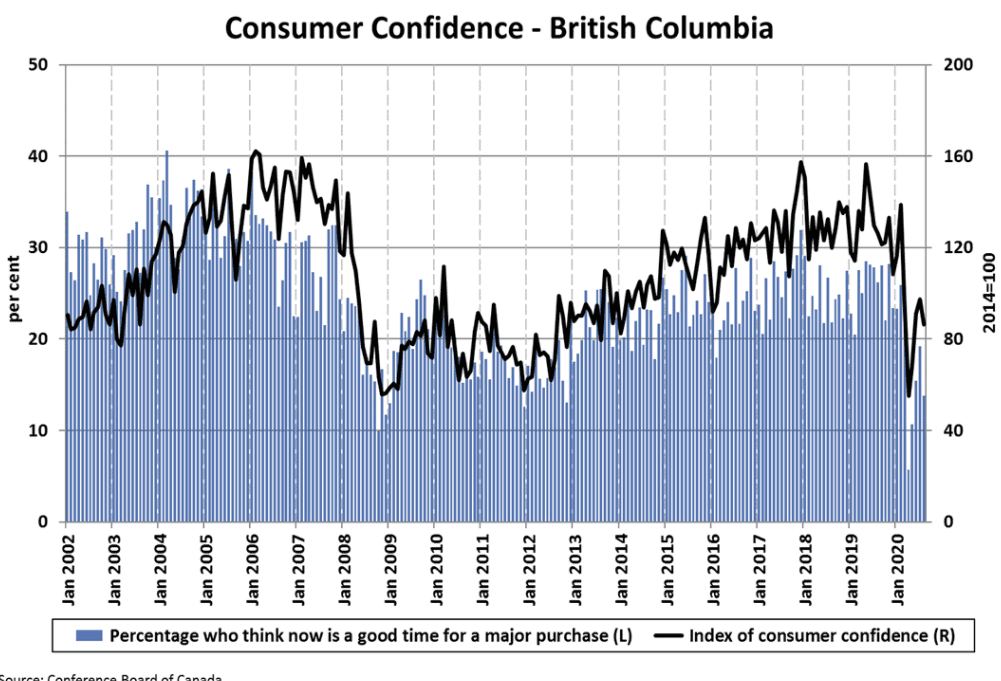

According to the Conference Board of Canada, consumer confidence in British Columbia posted a small increase in January 2021.

Concerning job prospects over the next six months, the number of respondents expressing pessimism moved higher in favour of more respondents expecting stability or an improvement.

The rest of Canada is also experiencing growth just like we are.

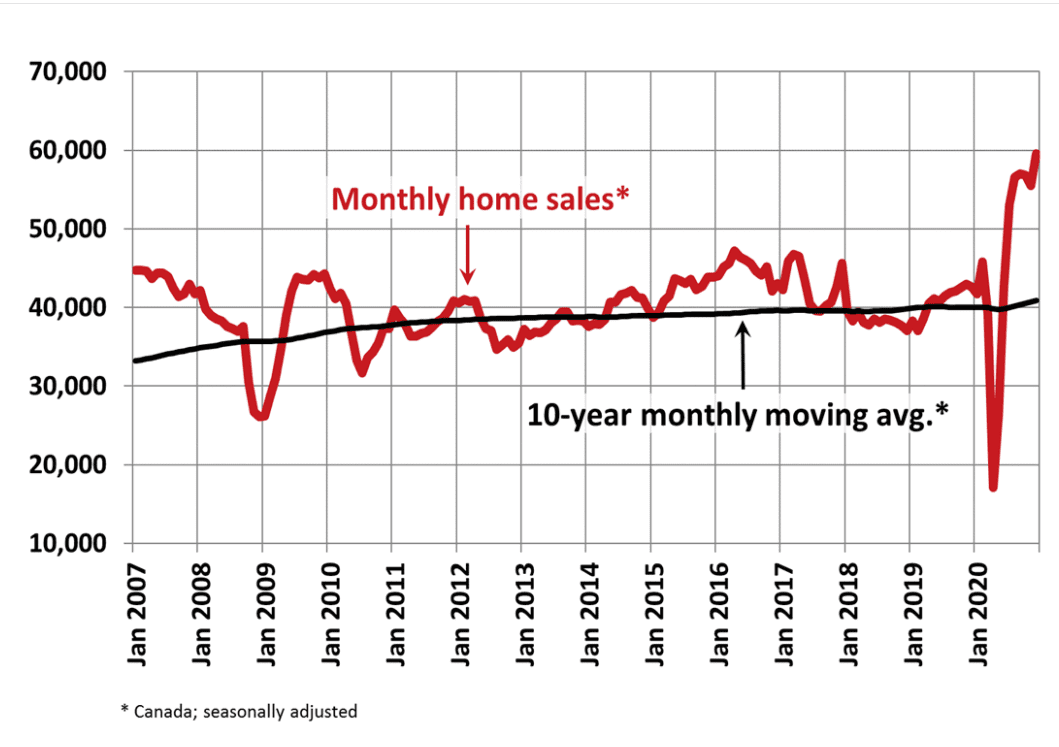

On New Year’s Day there were fewer than 100,000 residential listings on all Canadian MLS® Systems, the lowest ever based on records going back three decades. Compare that to five years ago, when there was a quarter of a million listings available for sale. So we have record-high demand and record-low supply to start the year. How that plays out in the sales and price data will depend on how many homes become available to buy in the months ahead.

With sales up by more than new supply in December, the national sales-to-new listings ratio tightened to 77.4% – among the highest levels on record for the measure. The long-term average for the national sales-to-new listings ratio is 54.2%.

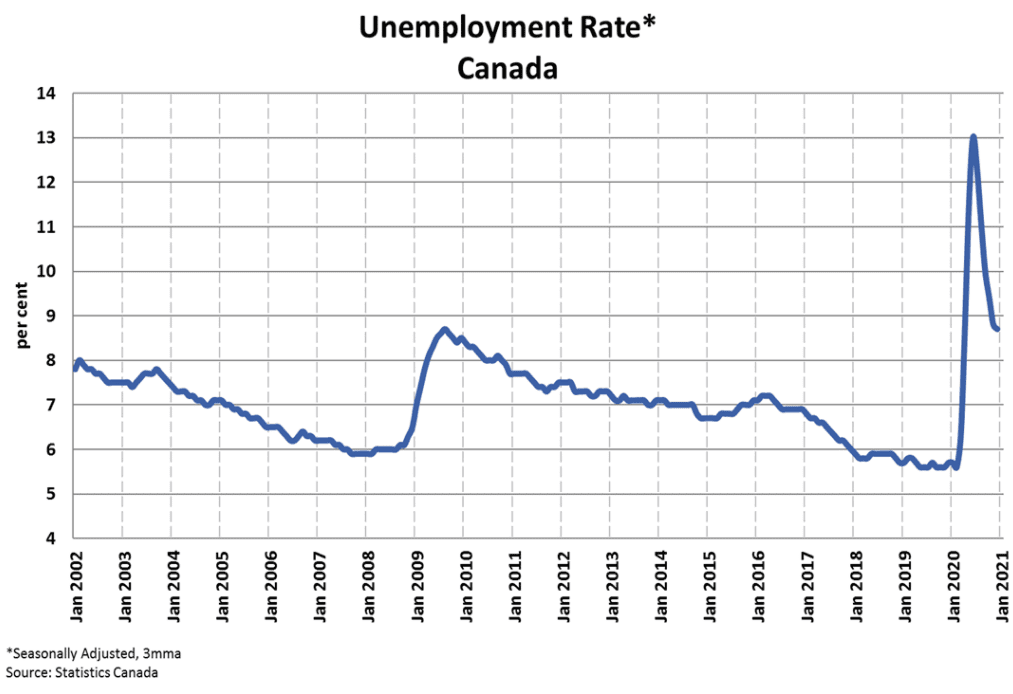

The unemployment rate in Canada was 8.8% as of February 2021, down 0.1% from the previous month. The unemployment rate stood 4.3% below the peak from June 2020 but remains above the long-run average.

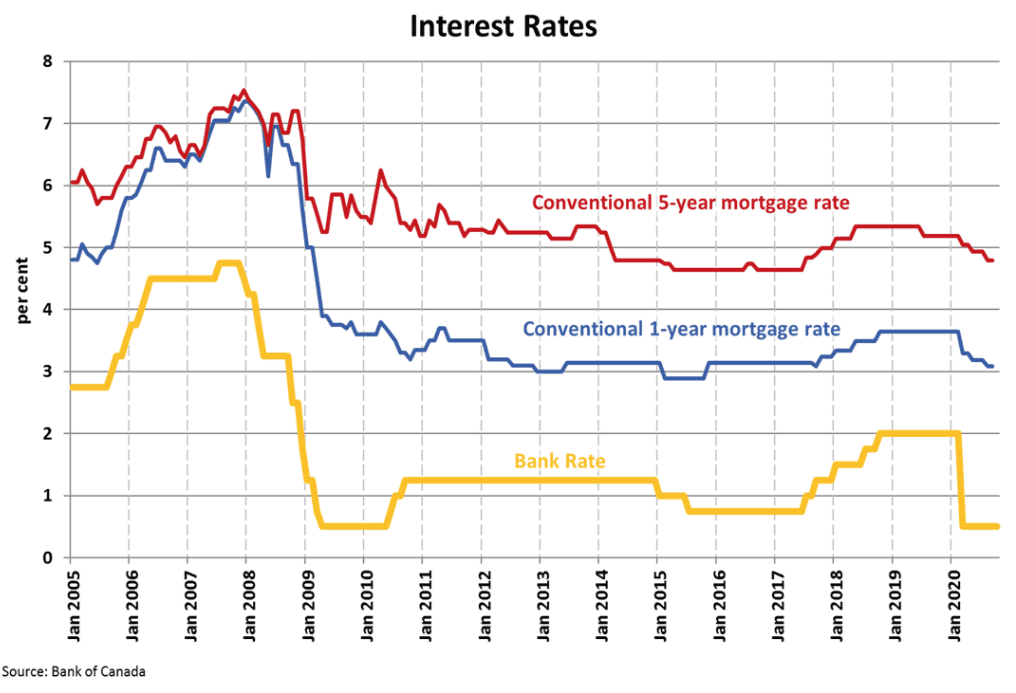

Bank Of Canada kept is target rate .

On March 10th, 2021, the Bank of Canada kept its target for the overnight lending rate at its effective lower bound of 0.25%. The Bank signaled it will continue to keep rates low until economic slack is absorbed and inflation is sustainably back to its 2% target, which the Bank doesn’t anticipate will happen until 2023. The Bank also recommitted to maintaining its extraordinary forward guidance, reinforced and supplemented by its quantitative easing (QE) program, which continues at its current pace of at least $4 billion per week.

As of March 10, 2021, the benchmark five-year lending rate was 4.79%. All mortgage applicants must qualify for financing based on an interest rate no less than the benchmark five-year lending rate, even if the mortgage is for less than five years.

Canada’s major chartered banks are currently advertising five-year fixed mortgage special interest rates of around 1.99%. Homebuyers can often negotiate the interest rate for mortgage financing based on their creditworthiness and the degree to which they do other banking business with the mortgage lender.

The Bank of Canada’s next scheduled interest rate announcement will be on April 21, 2021 and will be accompanied by a full update of the Bank’s outlook for the economy and inflation, including risks to the projection, in its Monetary Policy Report.

With so many changes occuring in our market it can be difficult to navigate and we look forward to answering any of your questions. If there are other items you would like to see in our monthly Nanaimo Real Estate market update please let us know. Thanks for reading De***@***********te.com