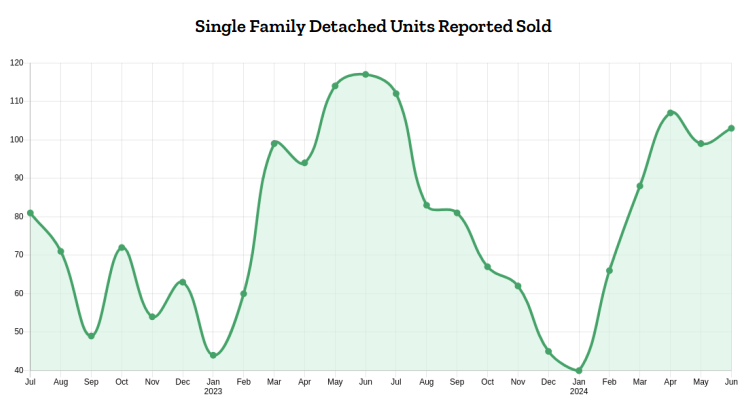

In June 2024, the Vancouver Island Real Estate Board (VIREB) reported a total of 737 property sales across all categories on the MLS® System. This included 359 single-family homes (excluding acreage and waterfront properties), reflecting a 15% drop from June 2023 and a 12% decrease from May 2024. Sales of condo apartments stood at 82, which is 24% lower than the previous year and 11% down from the previous month. Row/townhouse sales totaled 91, marking an 8% decline year-over-year and a 16% decrease from May.

The number of active single-family home listings in June was 1,566, up from 1,105 in June 2023. The inventory of condo apartments increased to 440 from 319 the previous year, and there were 364 row/townhouses available, compared to 274 in June 2023.

The real estate market has not seen the usual summer activity, and the anticipated boost from a recent interest rate cut has not occurred. Both buyers and sellers appear to be hesitant, waiting for clear signs to make their moves. While open houses and showings are happening, the market is slower than usual for this time of year. Well-priced, high-quality properties still attract multiple offers, but more buyers are submitting offers well below the asking price. With inventory levels at a five-year high, buyers have more options and time to decide, and sellers are also playing the waiting game.

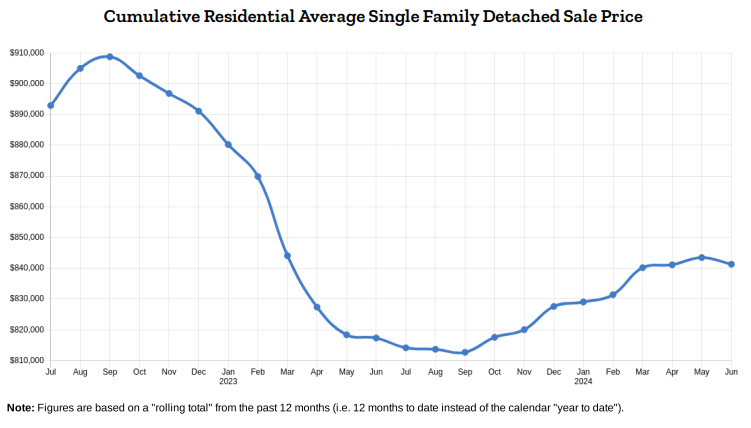

The benchmark price of a single-family home in June 2024 was $787,300, showing a 3% increase from the previous year and a 1% rise from May. For apartments, the benchmark price was $411,200, up 1% from June 2023 but slightly down from May 2024. The benchmark price for townhouses was $542,400, which is 2% lower than a year ago and slightly decreased from May.

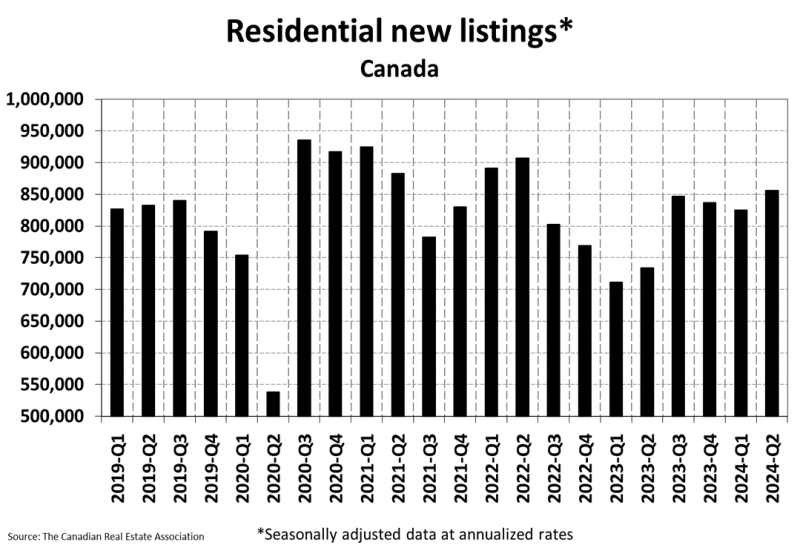

At the end of June 2024, about 180,000 properties were listed for sale on Canadian MLS® Systems, a 26% increase from the previous year but still below the historical average of around 200,000 for this time of year. Seasonally adjusted, the end-of-June supply was up only 0.5% from May, suggesting a slowdown in the inventory buildup.

New listings increased by 1.5% month-over-month in June, driven by the Greater Toronto Area and British Columbia’s Lower Mainland.

With the smaller national increase in new listings compared to sales gains in June, the national sales-to-new listings ratio tightened to 53.9% from 52.8% in May. The long-term average for this ratio is 55%, with a range of 45% to 65% indicating balanced market conditions.

The Chair of CREA stated that the second half of 2024 is expected to see a gradual return of buyers to the market. These buyers will encounter varied conditions across Canada, from multiple offers in Calgary to the highest inventory levels in over a decade in Toronto. Regardless of location, potential buyers are advised to have a solid plan and to contact a local REALTOR®.

Nationally, there were 4.2 months of inventory at the end of June 2024, down from 4.3 months at the end of May, marking the first month-over-month decline in inventory this year. The long-term average is about five months of inventory.

The National Composite MLS® Home Price Index (HPI) rose 0.1% from May to June, the first increase in 11 months.

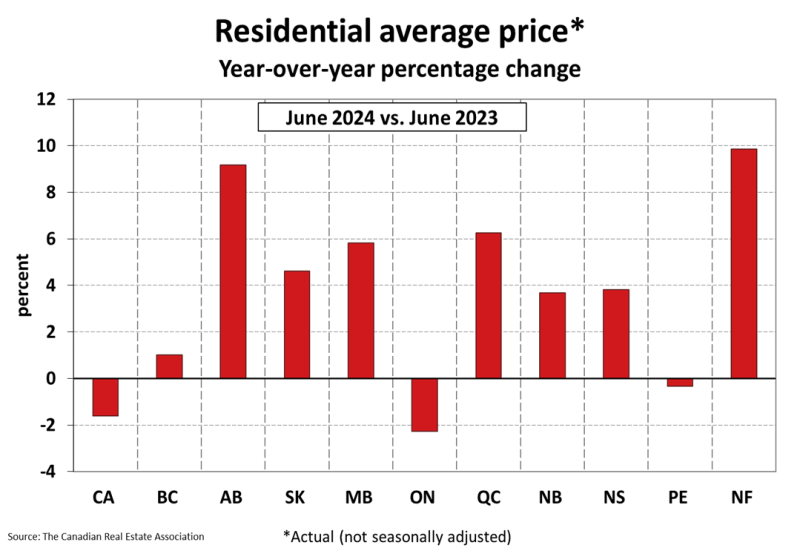

Regionally, prices have generally been stable across much of the country, with exceptions in Calgary, Edmonton, and Saskatoon, and to a lesser extent Montreal and Quebec City, where prices have been rising since early last year. Recently, prices have also started to increase in other markets, including Ontario cottage country, Mississauga, Hamilton-Burlington, Kitchener-Waterloo, Cambridge, London-St. Thomas, and Halifax-Dartmouth.

The non-seasonally adjusted National Composite MLS® HPI was 3.4% below June 2023, mainly due to last year’s price surge in April through July, which hasn’t been repeated in 2024.

The actual national average home price in June 2024 was $696,179, a 1.6% decrease from June 2023.

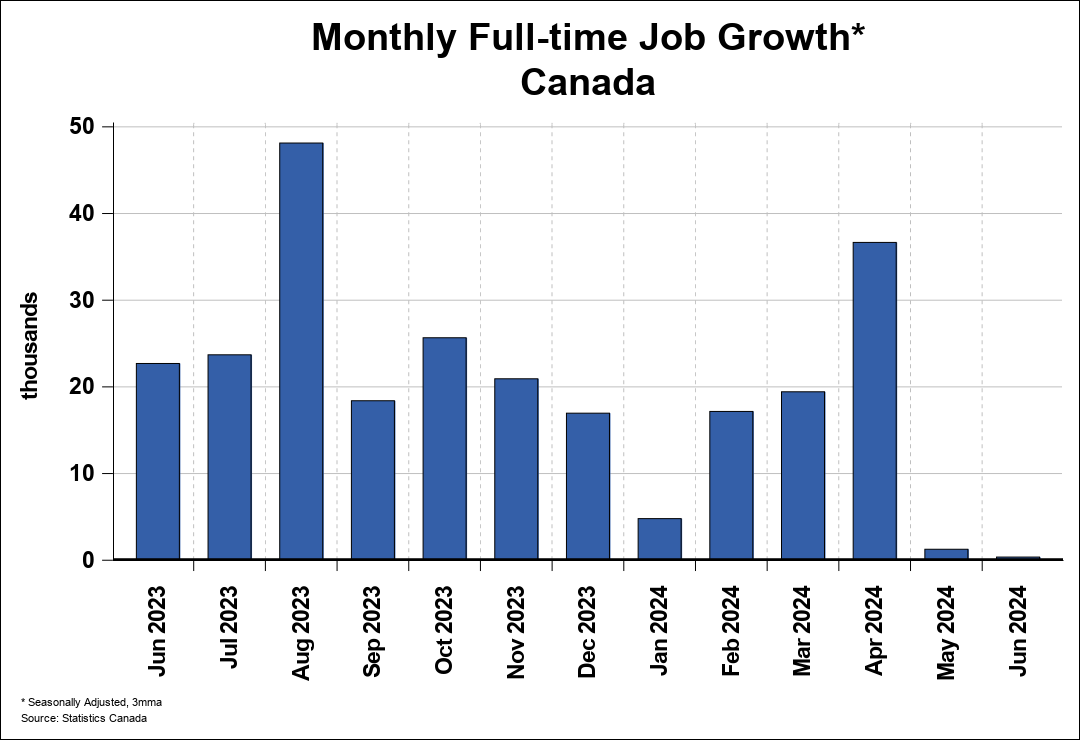

As of June 2024, Canada’s unemployment rate was 6.3%, a slight increase of 0.2% from the previous month. This rate is 7.1% lower than its peak in June 2020 and remains below the long-term average.

In June 2024, there were 400 more full-time jobs compared to the previous month, and an additional 38,100 part-time positions, resulting in a total increase of 38,500 jobs.

Full-time employment has rebounded since hitting a low in August 2022 and has now reached an all-time high.

All figures are seasonally adjusted using 3-month moving averages to eliminate normal seasonal variations.