Vancouver Island Market Stats

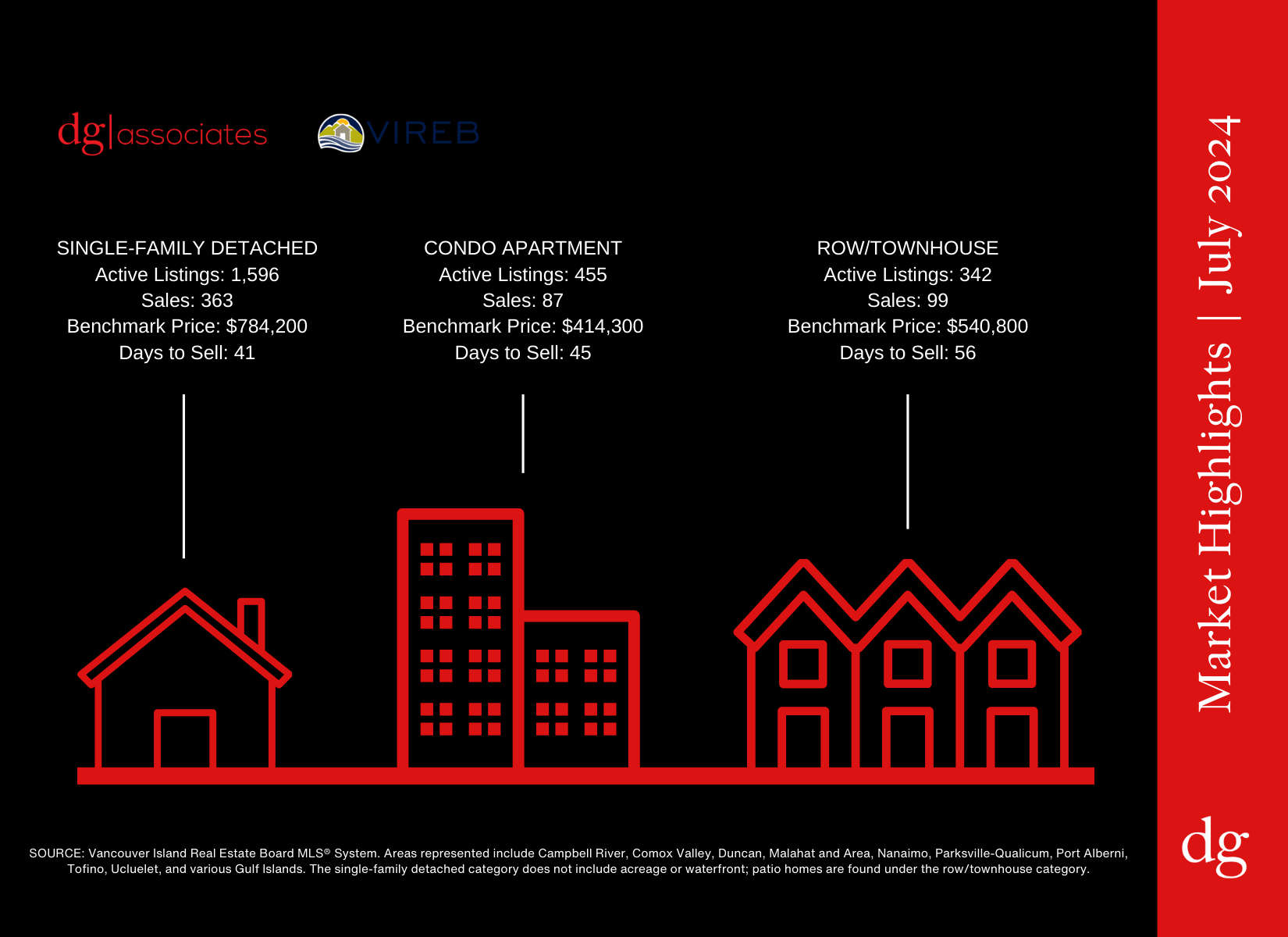

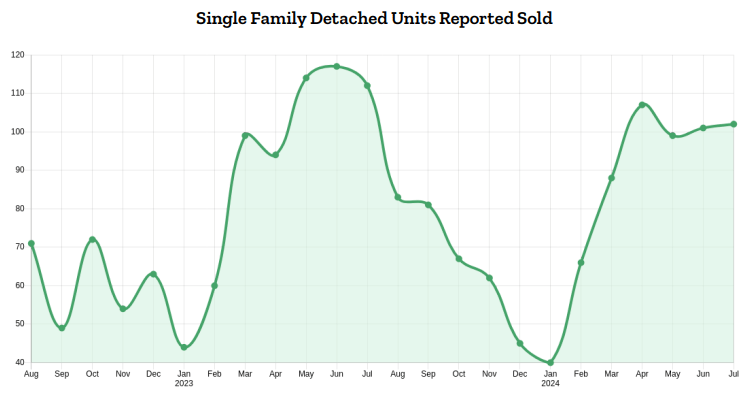

The Vancouver Island Real Estate Board (VIREB) reported a quieter July, with 737 unit sales across the board and 4,559 active listings on the MLS® System. In the single-family home category (excluding acreage and waterfront), 363 homes were sold in July, marking an 11% decrease from July 2023 but a slight 1% increase from June 2024. Condo apartment sales reached 87 units, down 9% year-over-year but up 6% from June. The row/townhouse category saw 99 sales, representing a 16% increase from the previous year and a 9% rise from June, according to July market stats.

Active listings for single-family homes rose to 1,596 in July, up from 1,092 a year ago. Condo apartment listings reached 455, an increase from 312 in July 2023, while row/townhouse listings climbed to 342 from 262 the previous year. With an absorption rate of 16% and about six months of inventory, the VIREB market is balanced but slowly shifting towards a buyer’s market.

Despite a strong local economy, the housing market on Vancouver Island remains subdued. The British Columbia Real Estate Association (BCREA) reports robust economic growth on Vancouver Island, the Lower Mainland, and Northern BC, while the Okanagan and Kootenay regions lag behind.

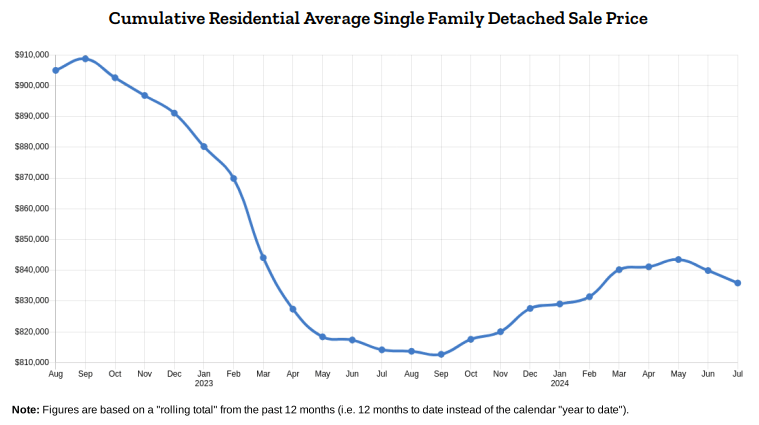

Price-wise, the board-wide benchmark price for a single-family home in July 2024 was $784,200, up 2% from a year ago but slightly down from June.

Campbell River: Benchmark price $705,700, up 4% year-over-year.

Comox Valley: Benchmark price $842,100, up 5%.

Cowichan Valley: Benchmark price $775,800, down 1%.

Nanaimo: Benchmark price $815,800, up 1%.

Parksville-Qualicum: Benchmark price $899,900, up 1%.

Port Alberni: Benchmark price $531,800, up 1%.

North Island: Benchmark price $431,300, down 2%.

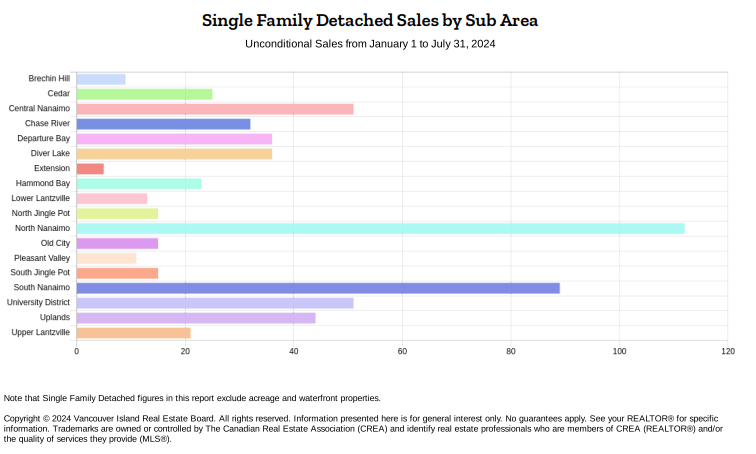

The below graph represents the Nanaimo area sales and prices for single family homes for July market stats

July Market Stats: Canada

The momentum in Canada’s housing market took a slight pause, following the initial boost in June after the Bank of Canada’s first interest rate cut since 2020. National home sales, as recorded on Canadian MLS® Systems, edged down by 0.7% compared to the previous month, giving back a small portion of June’s gains.

With another rate cut announced on July 24, expectations are high for further rate reductions this year, which could set the stage for increased housing activity as we approach 2025.

Some key highlights from July include:

– National home sales dipped 0.7% month-over-month.

– Actual monthly activity was 4.8% higher than in July 2023.

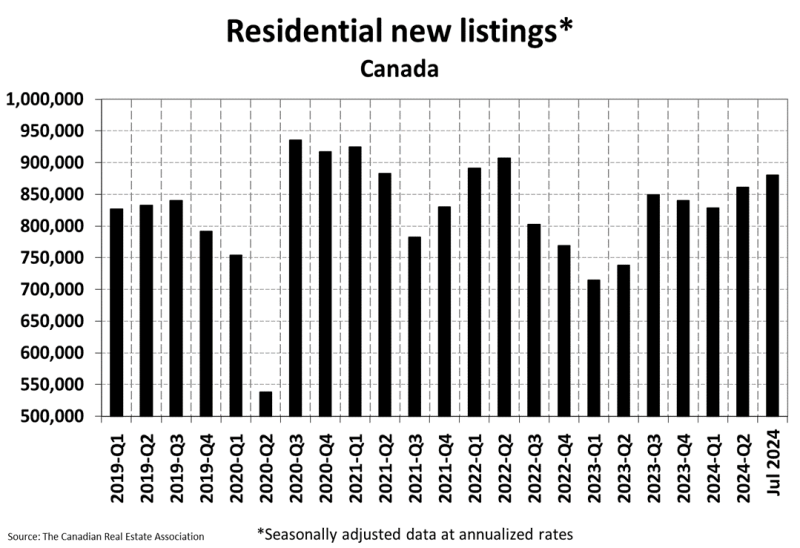

– Newly listed properties saw a 0.9% month-over-month increase.

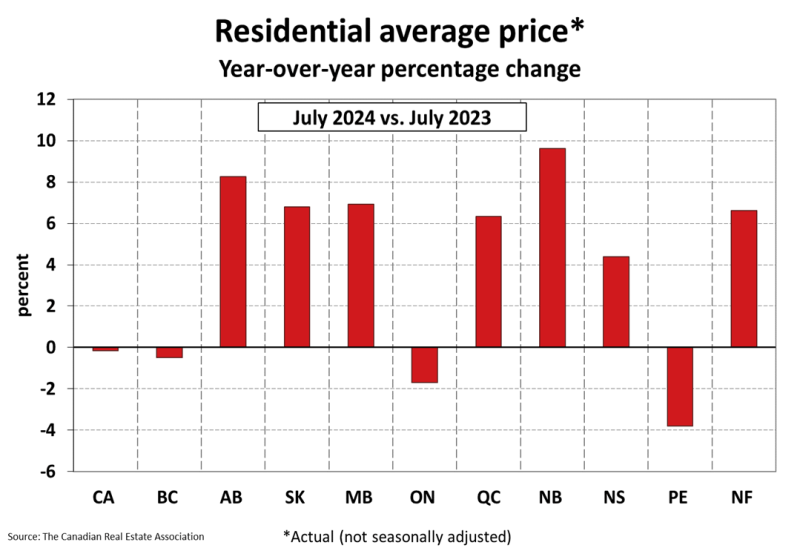

– The MLS® Home Price Index (HPI) edged up by 0.2% month-over-month, though it remains down 3.9% year-over-year.

– The national average sale price remained relatively unchanged from July 2023, down by just 0.2%.

Notably, there was a mix of small changes in sales activity across major markets. While Calgary and the Greater Toronto Area saw declines, Edmonton and Hamilton-Burlington experienced gains.

As of the end of July, there were about 183,450 properties listed for sale across Canada, a 22.7% increase from last year, though still below the historical average for this time of year. With new listings slightly up and sales slightly down, the national sales-to-new listings ratio eased to 52.7%, indicating balanced market conditions.

There remains a healthy inventory of homes for buyers, but with the potential for a more active market on the horizon, it may be an opportune time to consider making a move before competition heats up.

As we continue to monitor these trends, it’s crucial to stay informed and agile. Whether you’re looking to buy, sell, or simply stay ahead of the market, now is the time to strategize your next steps. Our team remains dedicated to providing you with the insights and personalized service you need to navigate this ever-evolving market.

Stay tuned for our next update as we guide you through the changing tides of Vancouver Island’s real estate landscape.

This conclusion wraps up the report by highlighting the current state of the market and subtly invites readers to reach out for more personalized advice.