Some of the reasons that have been cited for this trend include pent-up demand resulting from the lockdowns, financial support from government agencies, and ultra-low interest rates. Another wildcard factor to consider, which has no historical precedent, is the overall perceived value of one’s home during this time. Our homes have morphed into our workplace, our kids’ schools, our fitness center and so much more. The comfort and flexibility of our homes and personal space is more important than ever before.

With the restrictions in place we can see the impact on immigration as it added only 9,700 people to Canada’s population in the second quarter of 2020. This was a decrease of 93.6% from the same period in 2019 and marked the lowest level of net immigration since the fourth quarter of 2014. This was the first quarterly period during which COVID-19 resulted in the shutdown of most travel through Canadian borders.

The Vancouver Island Real Estate Board (VIREB) recorded 1,287 unit sales (all categories) last month compared to 692 in September 2019, a healthy showing amid the economic downturn caused by a global pandemic.

Breaking those numbers down, 643 single-family detached properties (excluding acreage and waterfront) sold in September compared to 324 the previous year. Sales of condo apartments rose by 46 per cent year over year while row/townhouse sales increased by 28 per cent.

The strength of our housing market has surprised many people and very few expected it to recover so quickly with some possible attributes to the recovery such as familiar factors: pent-up demand, low mortgage rates, and persistent supply shortages. The latter is an ongoing problem on Vancouver Island, which is a popular retirement destination and an attractive alternative for millennials seeking the West Coast lifestyle for less money than in Vancouver.

In the VIREB Vancouver Island Real Estate board area, active listings of single-family detached properties (excluding acreage and waterfront) were only 909 in September, while there were 389 condo apartments and 204 row/townhouses for sale last month.

While VIREB’s housing market remains strong, price-gain increments appear to be diminishing. Following a long period of significant gains, those numbers have tempered, with September posting a marginal rise in most regions. The benchmark price of a single-family home hit $527,300 in September, a marginal increase from the previous year and one per cent lower than in August. The year-over-year benchmark price of an apartment rose by three percent, hitting $309,400 but down slightly from the previous month. The benchmark price of a townhouse rose by six percent year over year, climbing to $434,300 and up slightly from August.

Campbell River, the benchmark price of a single-family home hit $454,200, a small increase over last year. Comox Valley, the benchmark price was $523,500, a slight dip from one year ago. Duncan reported a benchmark price of $489,000, an increase of one per cent from September 2019. Nanaimo’s benchmark price dropped by three per cent to $553,600. Parksville-Qualicum area saw its benchmark price increase by three per cent to $612,800. Port Alberni reached $329,500, up two per cent from one year ago. For the North Island, the benchmark price reached $222,400, a 10 per cent increase over last year.

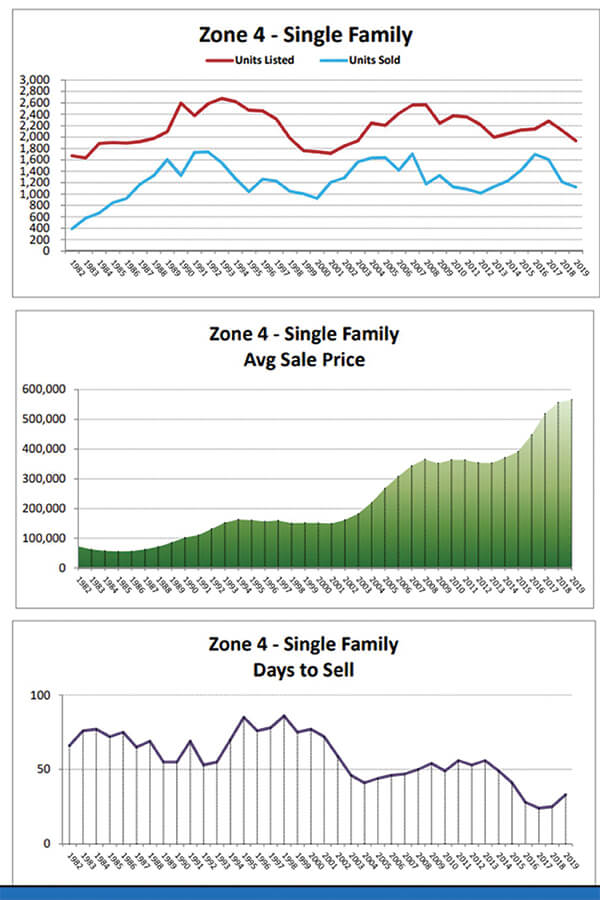

Historical sales and prices since 1982 in the Nanaimo area.

As I continue to network, my focus has been in the Vancouver region whereas in the past it was spread evenly among Calgary and Toronto. In my latest meetings I have noticed an uptick in the amount of people discussing making the move to Vancouver Island for the lifestyle. A large portion were talking about advancing their retirement plans, or simply downsizing to reduce their debt. In Nanaimo we have many market segments by price category as well as area, some are outperforming others. If you are interested in understanding the trends or looking at values just let me know.

Thanks again for reading our market update.

Derek