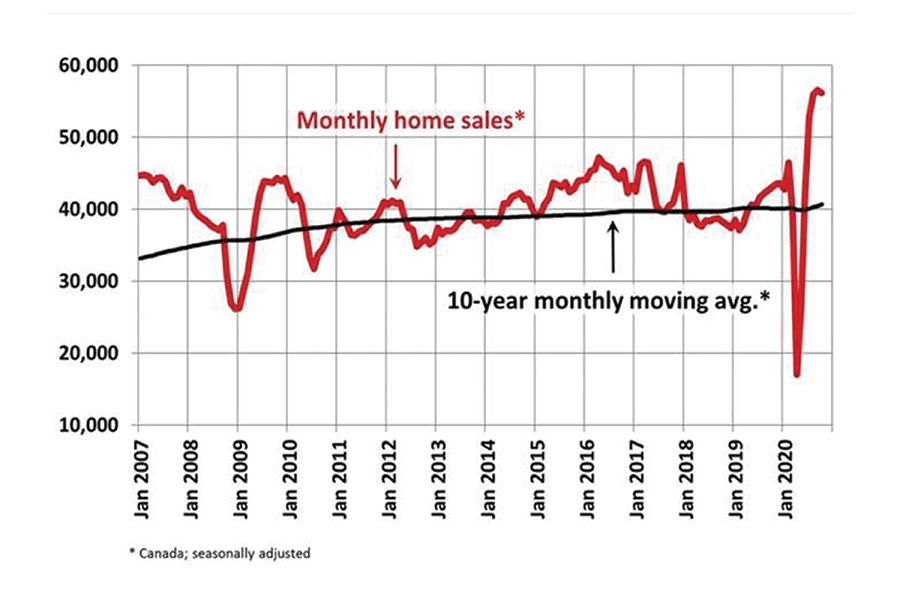

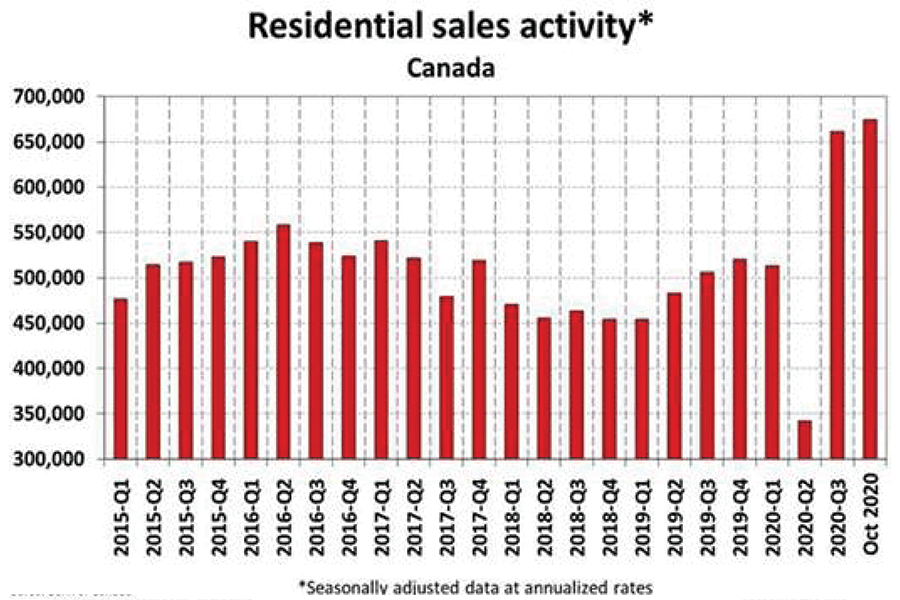

There has been some 461,818 homes that have traded hands over Canadian MLS® Systems, up 8.6% from the first 10 months of 2019. In fact, it was the second-highest January-October sales figure on record, trailing only 2016.

The Canadian housing markets continue to see historically strong levels of activity, and at this point over and above what would have been required to make up for the very quiet spring market this year.

This seems to go against normal trends as traditional drivers of the market like, economic growth, employment and confidence, are currently weak. Perhaps households are choosing to pull up stakes and move as a result of COVID and all the associated changes to our lives. We could be seeing activity in the market that would not have happened in a non-COVID world.

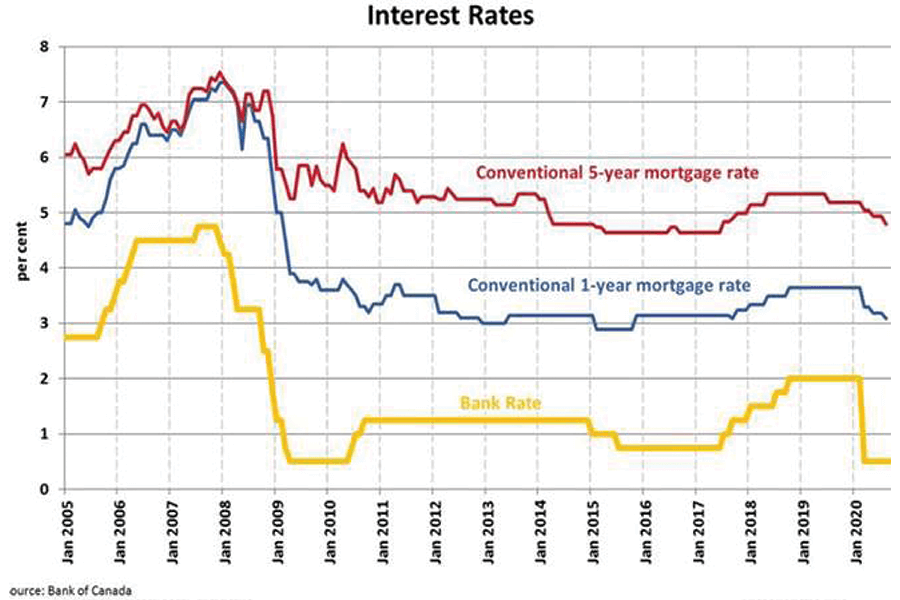

An important factor in stimulating the Real Estate market are interest rates and The Bank of Canada does not expect to begin raising rates until at least 2023.

In a scheduled announcement on October 28th, 2020, the Bank of Canada maintained its overnight lending rate at 0.25%. The Bank noted that economic headwinds are rising as the number of COVID-19 cases continues to increase.

As the number of COVID-19 cases increases both within Canada and abroad, the recovery is expected to be slow. The Bank stated that it will hold the policy interest rate at its effective lower bound until economic slack is absorbed, and the 2% inflation target is sustainably achieved.

Another imbalance in our economy is net immigration, adding only 9,700 people to Canada’s population in the second quarter of 2020. This was a decrease of 93.6% from the same period in 2019 and marked the lowest level of net immigration since the fourth quarter of 2014. Canada was recently ranked as one of the best places to live in the world, therefore we may see a larger influx once immigration opens up.

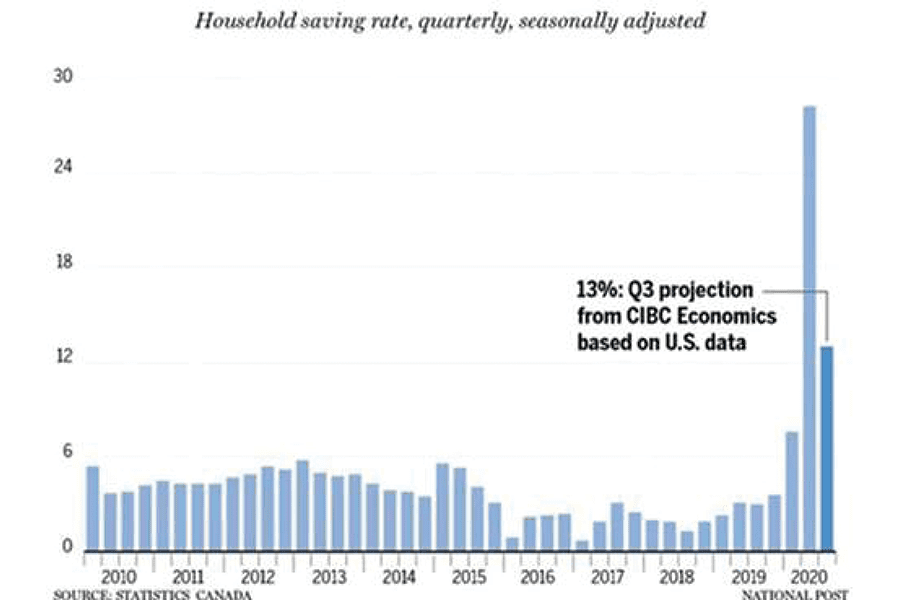

Personal savings imbalance is continuing to grow. A recent report from CIBC states that around $90 billion in excess cash is being held in personal accounts — which is the highest in the country’s history and equal to about four per cent of consumer spending. The same report said that Canadian businesses, are hoarding another $80 billion. The savings rate in the second quarter of 2020 surged to 28.2 per cent, up from 3.6 per cent before the COVID-19 pandemic struck. Consumer spending in recent months has rebounded from its lows early in the pandemic, but has yet to return to normal levels as restaurants operate at below capacity and bricks-and-mortar retail stores remain mostly empty.

This imbalance could restrict the economy further and impact more businesses, resulting in bankruptcies which would continue the cycle of people holding cash instead of spending.

Our local market on Vancouver Island (VIREB) recorded 1,066 unit sales (all categories) last month compared to 721 in October 2019.

Breaking those numbers down, 524 single-family detached properties (excluding acreage and waterfront) sold in October compared to 342 the previous year, a 53 per cent increase but a decrease of 18 per cent from September. Sales of condo apartments rose by 48 per cent year over year and six per cent month over month. Row/townhouse sales increased by 51 per cent from October 2019 but dipped by 10 per cent from the previous month. We feel the slightly lower sales is due more to the lack of inventory not a weakening of the market.

Active listings of single-family detached properties (excluding acreage and waterfront) were 733 in October compared to 909 in September, this is also due to the time of the year.

To see if the trend continues for our local market we need to understand that some of this demand includes buyers who are advancing their retirement plans, others are downsizing and reducing their debt and another segments are doing more work from home which creates the opportunity to relocate out of the bigger centers to more attractive lifestyle communities.

The benchmark price of a single-family home hit $536,500 in October, an increase of three per cent year-over-year and two per cent lower than in September. The year-over-year benchmark price of an apartment rose by three per cent, hitting $304,200 but down by two per cent from the previous month. The benchmark price of a townhouse rose by nine percent year-over-year, climbing to $438,200 and an increase of one per cent from September.

· Campbell River, the benchmark price of a single-family home hit $468,300, an increase of five per cent over last year.

· Comox Valley, the benchmark price was $534,300, a slight increase from one year ago.

· Duncan reported a benchmark price of $498,400, an increase of three per cent from October 2019.

· Nanaimo’s benchmark price decreased slightly to $558,100.

· Parksville-Qualicum area saw its benchmark price increase by six per cent to $619,600.

· Port Alberni reached $339,900, up by two per cent from one year ago.

· North Island, the benchmark price reached $229,000, a 15 per cent increase over last year.

As we navigate through these unprecedented times, it requires a close watch on local and Canadian wide trends to see how they can effect Real Estate and your investment. We are fortunate to enjoy the lifestyle and lower number of COVID cases on Vancouver Island and we all want to keep it that way.

As an experienced Professional in our Industry I’m always asked if I enjoy all the growth, my response is from a family perspective first. I believe in a healthy but more importantly, balanced market for everyone. Moderate yet sustainable growth is important, I want my children and grandchildren to grow up and enjoy the opportunities and lifestyle I was fortunate enough to have.