When we look back a year (or to last months stats we released), July 2022 had a 60.43% increase in the number of new listings compared to July of 2021. Looking at August we have a 0.65% change from August of last year (1 more listing than 2021). August still had more inventory than usual due to the increased inventory from July that was still on the market. As a result, there was still a higher supply than demand. 72 properties were sold in the month of August. This is a decrease of 44.19% from August of 2021.

Higher inventory and lower demand indicate that the housing market will start to shift. We didn’t feel this in August as the average home price increased slightly from $878,302 in July to $881,254 (15.06% higher than 2021). August saw a lower sale to list price ratio than June, however, looking at sale values the number of sales above the million-dollar mark have increased, contributing to the increase in average price for the month.

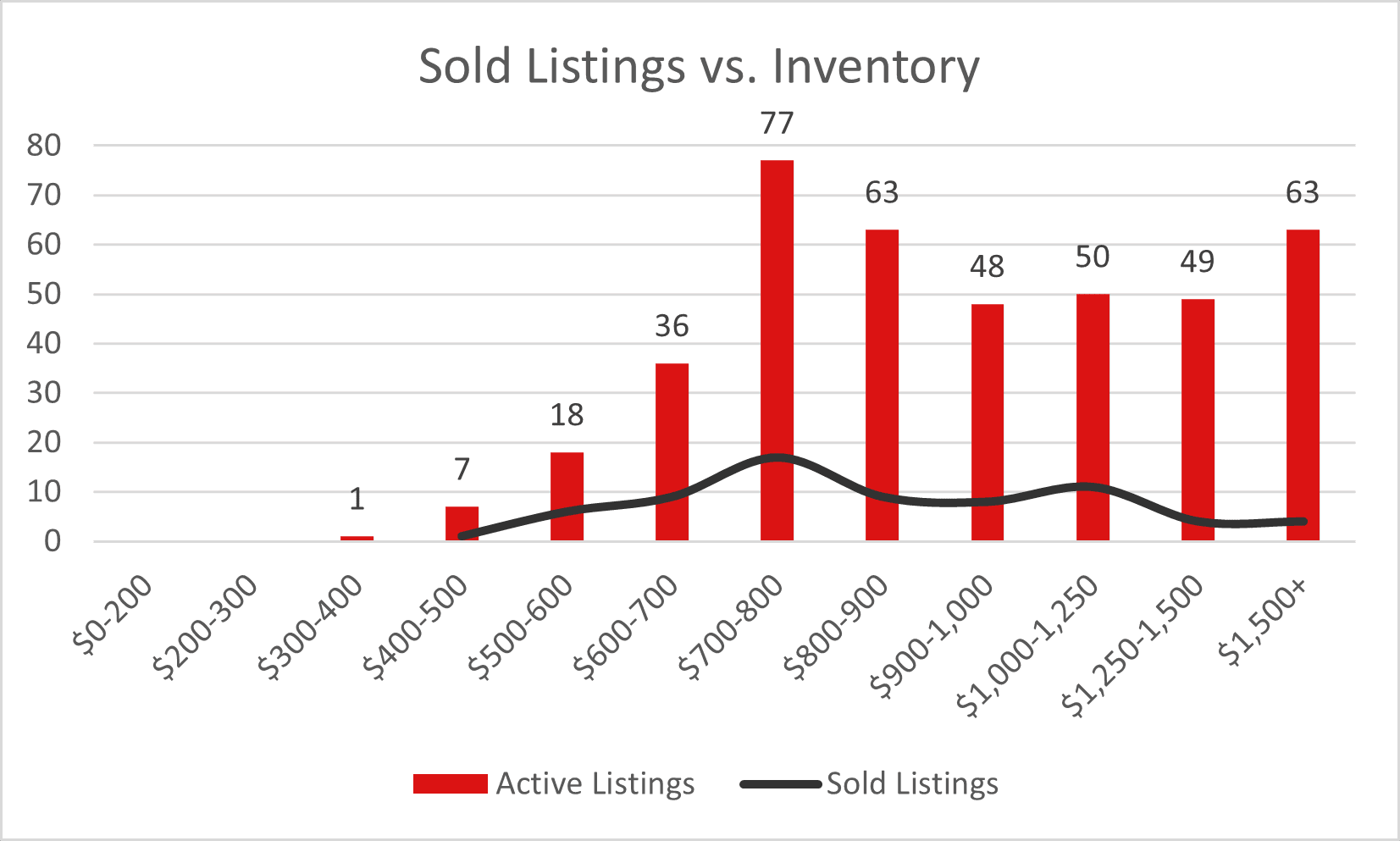

Looking at single family homes, the median price increased from $815,00 in July to $823,750, meaning that the highest and lowest priced sale was on the rise for single family home. This can also be attribute to the increase in transactions in the million dollar plus market, and only one single family home sold in the $3-400,000 range. While there was an increase in the average home price, it is a different kind of increase than what we have been saying in recent years. In the past few years, we were seeing demand driven price increases where the price was going up to meet the amount of demand in the market. This contributed to rising prices over asking, multiple offers and less subjects in those offers. This month’s average sale price increase was attributed more to the higher value property sales. While the average price did increase, we saw that on average homes were selling for about 2% less than asking price. Along with more homes selling for below the list price, days on market also increased, which is an indicator that there have been more properties sold with subjects such as finance, inspection, and even subject to the sale of the buyer’s home.