Single Family

Single family homes in Nanaimo saw a year over year decrease of 23.33% in the number of sales reported for January 2023. Month over month, January had a larger decrease in sales from December of 2022. Historically, January is typically a busier month for real estate than December as people are getting back to their search after the holiday season.

Over the past two years, we have seen a decrease in the number of sales when we compare January to the previous month. With an increase in supply and decrease in demand this has helped to decrease the average home price by 20.74% from January of 2022.

If economists are correct in thinking that a 20% decrease in home prices is the bottom of the market, this signals that the market could be on it’s way to stabilizing. What remains to be seen is how many buyers will start to come back to the market with prices decreasing and the Bank of Canada wanting to commit to pausing interest rate increases.

While price decreases in the real estate market often start to increase the amount of transactions happening in the market, these price decreases we have seen over the last year can be attributed to a few different factors including the increases in variable and fixed mortgage rates subjecting buyers to higher stress test rates in the mortgage qualification process and reducing the average mortgage approval amounts. With lower mortgage affordability across the board home prices had to shift to match market demand.

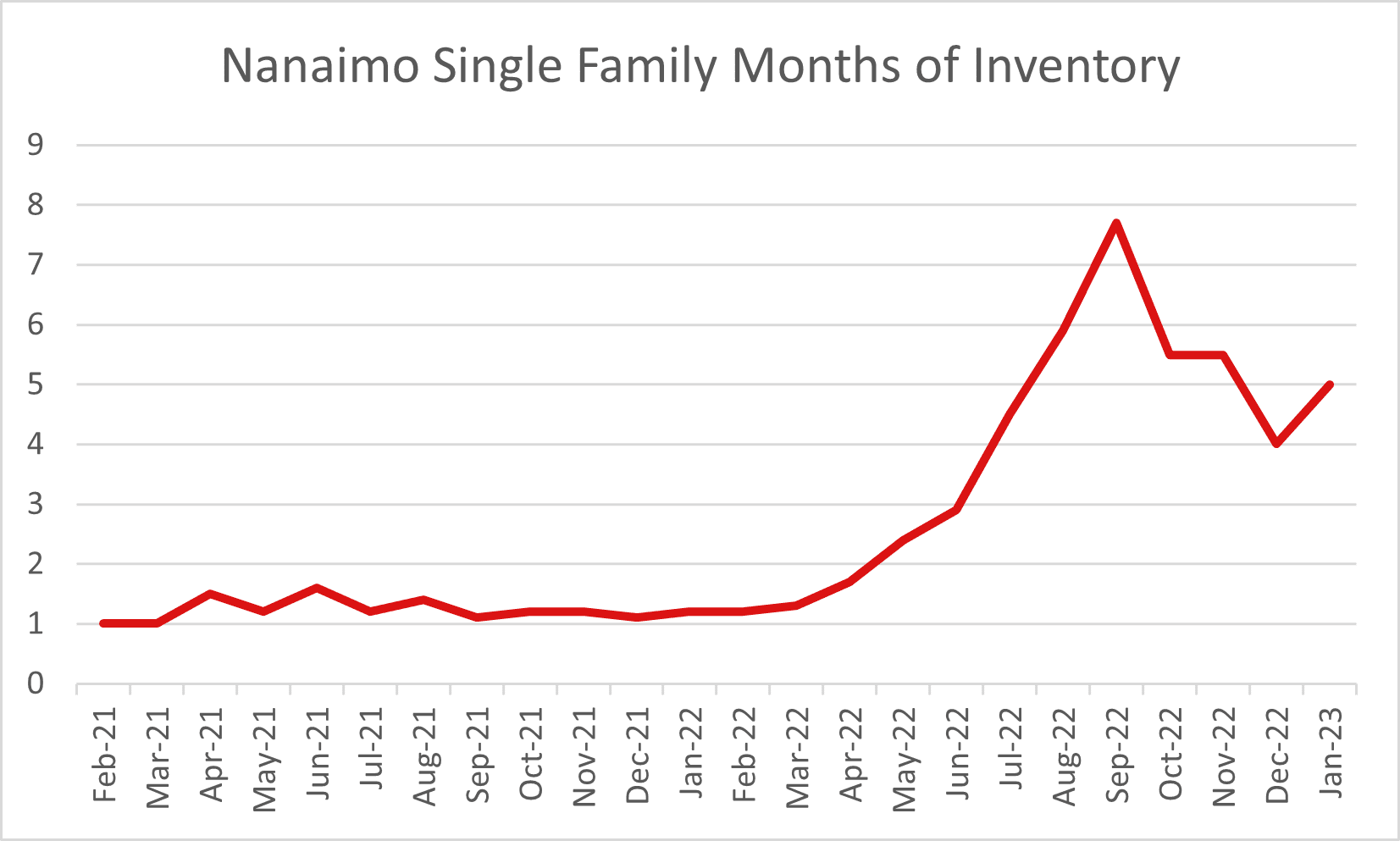

Market demand decreased month over month from December where we had 64 single family sales compared to 46 sales in January. Supply increased significantly with 112 new listings in January compared to 45 new listings in December. With more new listings than sales in January this has increased the months of inventory available pushing the market closer to a balanced market between buyers and sellers.

When months of inventory starts to increase it changes the competitive landscape of the housing market by providing more options to buyers. Where this month was unique was that we saw an increase in supply, a decrease in demand, but an increase in the sale to list price ratio.

In December, the sale to list ratio was 96.91%. In January this was 98.38%. This increase can be partly attributed to new inventory that hit the Nanaimo real estate market that attracted a lot of buyers based on value and price point. While some listings have been sitting on the market longer and contributing to an 88% increase in the days on market from January 2022 to 2023, listings that have attracted more attention from buyers are selling within days of being listed, very close to the asking price, Multiple offers have also started to come back, but not on every listing, and have not been going as much over the asking price like we had seen during the peak of the market.

Townhomes

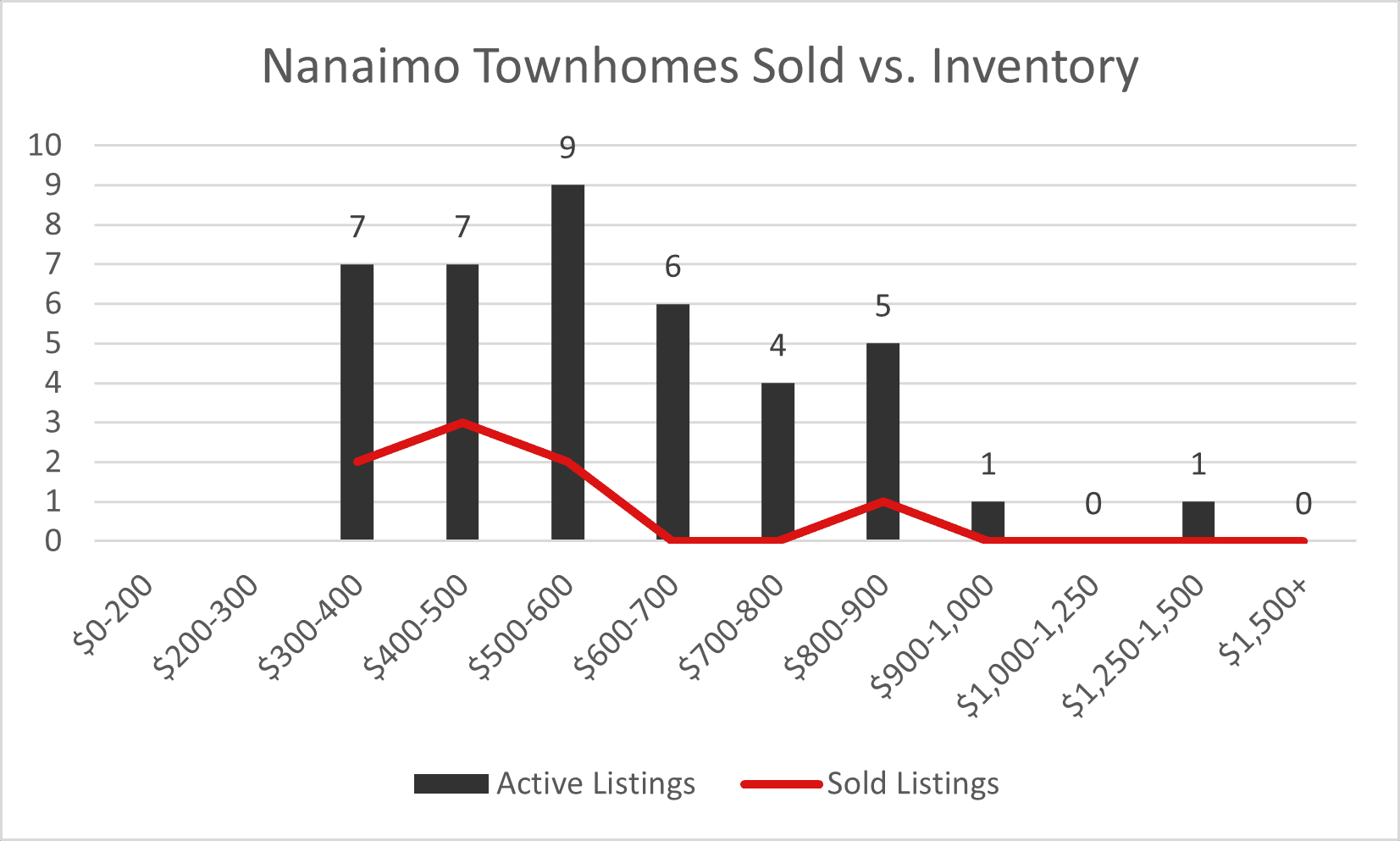

Townhomes in Nanaimo also saw an increase in the average price month over month from $499,200 in December to $513,050 in January 2023. This is still down 22.6% from the townhome market year over year.

Similarly to the single family housing market, we saw a significant increase in the amount of new listings month over month. Where townhomes differ from single family homes is that transactions stayed almost the same as December. With less inventory turning over than the single family home market, the sale to list ratio of townhomes decreased. With a decrease in the sale to list ratio and an increase in the average sale price, this indicates that the listings sold in January were at a higher value than December.

These changes in stats for townhomes tend to fluctuate more than single family homes due to the difference in available inventory. Where single family homes active listings in the month of January was 205, townhome active listings were at 38. This means that buyers in the market for a townhome have less choice when it comes to find a new home. With less inventory available this creates a lower months of inventory where sellers are able to increase their list price, however, the amount of buyers in the market currently means that these homes are sitting on the market longer and are negotiating more on their list price than the typical single family home. This means that there is currently less competition in the townhome market than single family homes.

Condos

Condos saw the biggest change in average price with a decrease of 23.43%. There was also a 69.7% decrease in the number of transactions in the Nanaimo condo market. With this change being such a big difference from both single family and townhomes, it’s important to look at where the difference comes into play.

In January and February of last year there were presales of Lakeview Terrace which allowed some buyers to be able to purchase a home with less competition if they could wait for the building to be complete. Month over month, the amount of transactions stayed fairly consistent, but an increase in inventory created a decrease in the average price from the end of 2022.

Vancouver Island Comparison

When comparing the Nanaimo real estate market statistics to the rest of the VIREB area, evidence supports that Nanaimo continues to be a great place to invest on Vancouver Island. The average single family home price in Nanaimo decreased about 4% less than the rest of the island. Nanaimo’s average single family home price is 8.36% higher than the average home price on Vancouver Island. Homes in Nanaimo also see a shorter amount of time on market suggesting that the Nanaimo real estate market has stayed busier than the rest of the island.

In our experience, a large part of this is how desired Nanaimo has become for people looking to relocate to the island, but have the convenience of being able to hop on the ferry or plane to be in Vancouver. The progression of the Nanaimo fast-ferry will make travel even more efficient enabling Nanaimo to continue to be one of the fastest growing cities in Canada.