This is our last Market Insight for the year as we round out the end of 2021. Watch for our special report in January with a more detailed forecast for 2022, once the final numbers roll in from December’s sales.

In this market intelligence report we review the Canadian supply vs sales with a closer look at our local market. We will also look at Bank of Canada announcements on interest rates and consumer confidence nationally and in BC.

As we roll into the last month of 2021 National home sales recorded more gains over Canadian MLS® Systems which increased 8.6% between September and October 2021, marking the largest month-over-month increase since July 2020.

Sales were up month over month in about three-quarters of all local markets, and in all major cities.

The actual (not seasonally adjusted) number of transactions in October 2021 was down 11.5% on a year-over-year basis from the record for that month set last year. That said, it was still the second-highest ever October sales figure by a sizeable margin.

On a year-to-date basis, some 581,275 residential properties traded hands via Canadian MLS® Systems from January to October 2021, surpassing the annual record of 552,423 sales for all of 2020.

Here in BC, the Housing market continues at historically low levels of supply.

The supply situation is especially critical in markets outside the Lower Mainland. One of the worst inventory situations remains for us locally on Vancouver Island. Even if sales were to return to long-run average levels, total listings would need to double to achieve a balanced market, and the road to doubling those listings lies in building more homes.

Vancouver Island

Active listings in the Vancouver Island Real Estate Board area continue to drop, with demand far outpacing supply. Inventory has hit consecutive historical lows for several months running.

Active listings of single-family homes were 44 per cent lower last month than in November 2020 and dropped by 24 per cent from the previous month. VIREB’s inventory of condo apartments declined by 69 per cent from one year ago and was 23 per cent lower than in October. Row/townhouse inventory dropped by 55 per cent year over year and was 47 per cent lower than the previous month.

By category, 353 single-family homes sold on the MLS® System in November, a 16 per cent decrease from one year ago.

VIREB (Vancouver Island Real Estate Board) welcomes the news that the Government of British Columbia is giving local governments more tools and powers to simplify and speed up their development approvals processes. The changes announced by the government include removing requirements for local governments to hold public hearings for development proposals that already align with Official Community Plans and equipping municipal staff to make decisions for minor development variance permits.

The board-wide benchmark price of a single-family home reached $769,700 in November, up 33 per cent year over year. In the apartment category, the benchmark price hit $401,100 last month, a 29 per cent increase from November 2020. The benchmark price of a townhouse increased by 35 per cent, reaching $594,400 in November.

• In Campbell River the benchmark price of a single-family home hit $683,500 up by 30 per cent from the previous year.

• In the Comox Valley, the year-over-year benchmark price rose by 32 per cent to $785,300.

• The Cowichan Valley reported a benchmark price of $770,000, an increase of 33 per cent Parksville-Qualicum area saw its benchmark price increase by 35 per cent to $903,300.

• Port Alberni reached $509,100, a 40 per cent year-over-year increase.

• The benchmark price for the North Island rose by 51 per cent, hitting $417,700 in November.

Our Local Nanaimo and Area Market

Nanaimo’s benchmark price rose by 29 per cent, hitting $768,700.

Interest Rates

Bank of Canada maintains policy rate and forward guidance.

In its penultimate interest rate announcement for this calendar year, the Bank of Canada today held its target for the overnight rate at the effective lower bound of ¼ percent, with the Bank Rate at ½ percent and the deposit rate at ¼ percent. The Bank’s extraordinary forward guidance on the path for the overnight rate is being maintained. The Bank is continuing its reinvestment phase, keeping its overall holdings of Government of Canada bonds roughly constant.

The global economy continues to recover from the effects of the COVID-19 pandemic. Economic growth in the United States has accelerated, led by consumption, while growth in some other regions is moderating after a strong third quarter. Inflation has increased further in many countries, reflecting strong demand for goods amid ongoing supply disruptions. The new Omicron COVID-19 variant has prompted a tightening of travel restrictions in many countries and a decline in oil prices, and has injected renewed uncertainty. Accommodative financial conditions are still supporting economic activity.

Canada’s economy grew by about 5½ percent in the third quarter, as expected. Together with a downward revision to the second quarter, this brings the level of GDP to about 1½ percent below its level in the last quarter of 2019, before the pandemic began. Third-quarter growth was led by a rebound in consumption, particularly services, as restrictions were further eased and higher vaccination rates improved confidence. Persistent supply bottlenecks continued to inhibit growth in other components of GDP, including non-commodity exports and business investment.

Recent economic indicators suggest the economy had considerable momentum into the fourth quarter. This includes broad-based job gains in recent months that have brought the employment rate essentially back to its pre-pandemic level. Job vacancies remain elevated and wage growth has also picked up. Housing activity had been moderating, but appears to be regaining strength, notably in resales. The devastating floods in British Columbia and uncertainties arising from the Omicron variant could weigh on growth by compounding supply chain disruptions and reducing demand for some services.

CPI inflation is elevated and the impact of global supply constraints is feeding through to a broader range of goods prices. The effects of these constraints on prices will likely take some time to work their way through, given existing supply backlogs. Gasoline prices, which had been a major factor pushing up CPI inflation, have recently declined. Meanwhile, core measures of inflation are little changed since September. The Bank continues to expect CPI inflation to remain elevated in the first half of 2022 and ease back towards 2 percent in the second half of the year. The Bank is closely watching inflation expectations and labour costs to ensure that the forces pushing up prices do not become embedded in ongoing inflation.

The Governing Council judges that in view of ongoing excess capacity, the economy continues to require considerable monetary policy support. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank’s October projection, this happens sometime in the middle quarters of 2022. We will provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation target.

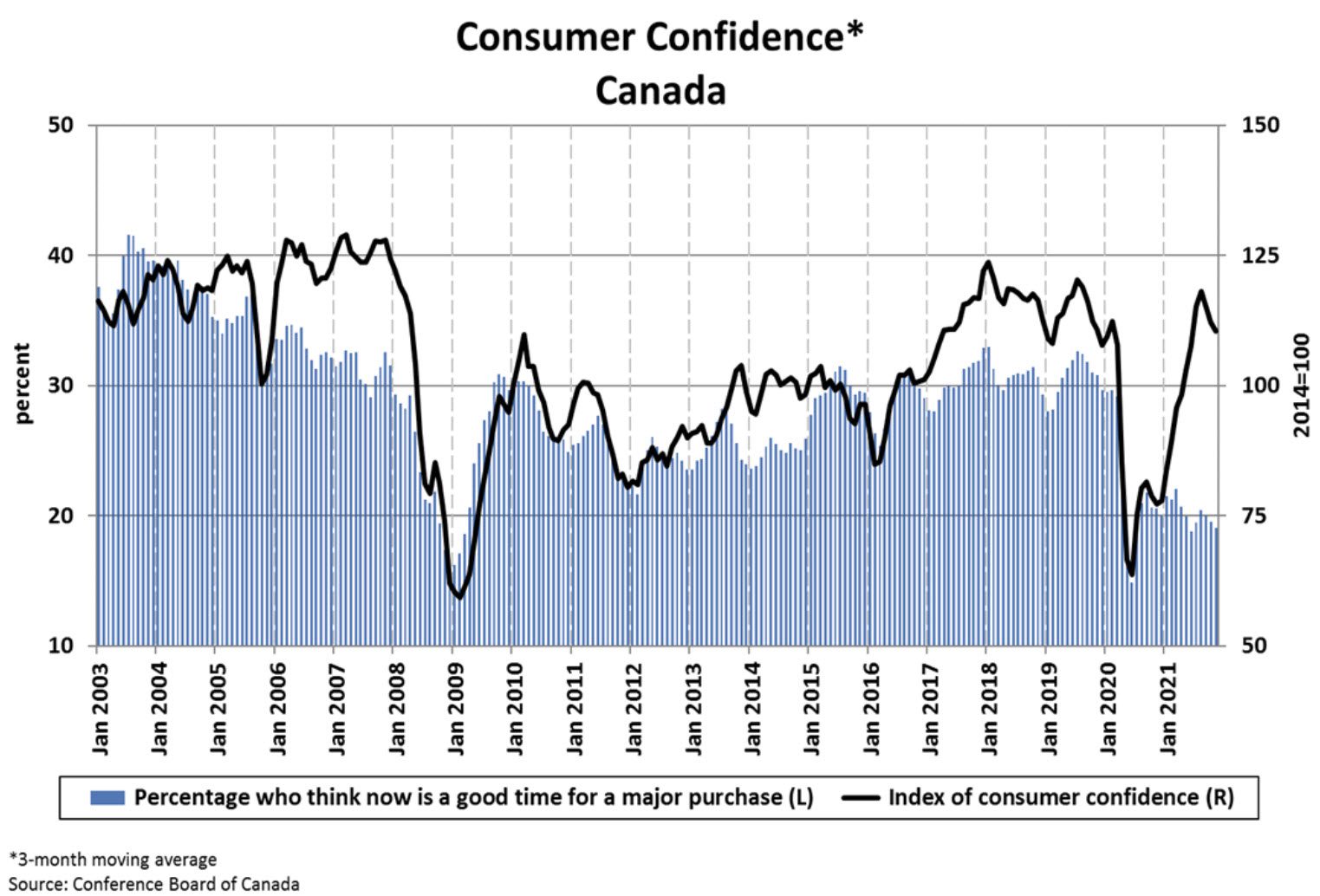

National Consumer Confidence

National consumer confidence fell for a third consecutive month in November 2021 after reaching levels seen before the onset of the COVID-19 pandemic, according to the Conference Board of Canada’s survey-based index of consumer confidence.

Overall sentiment was down across most of the country in November.

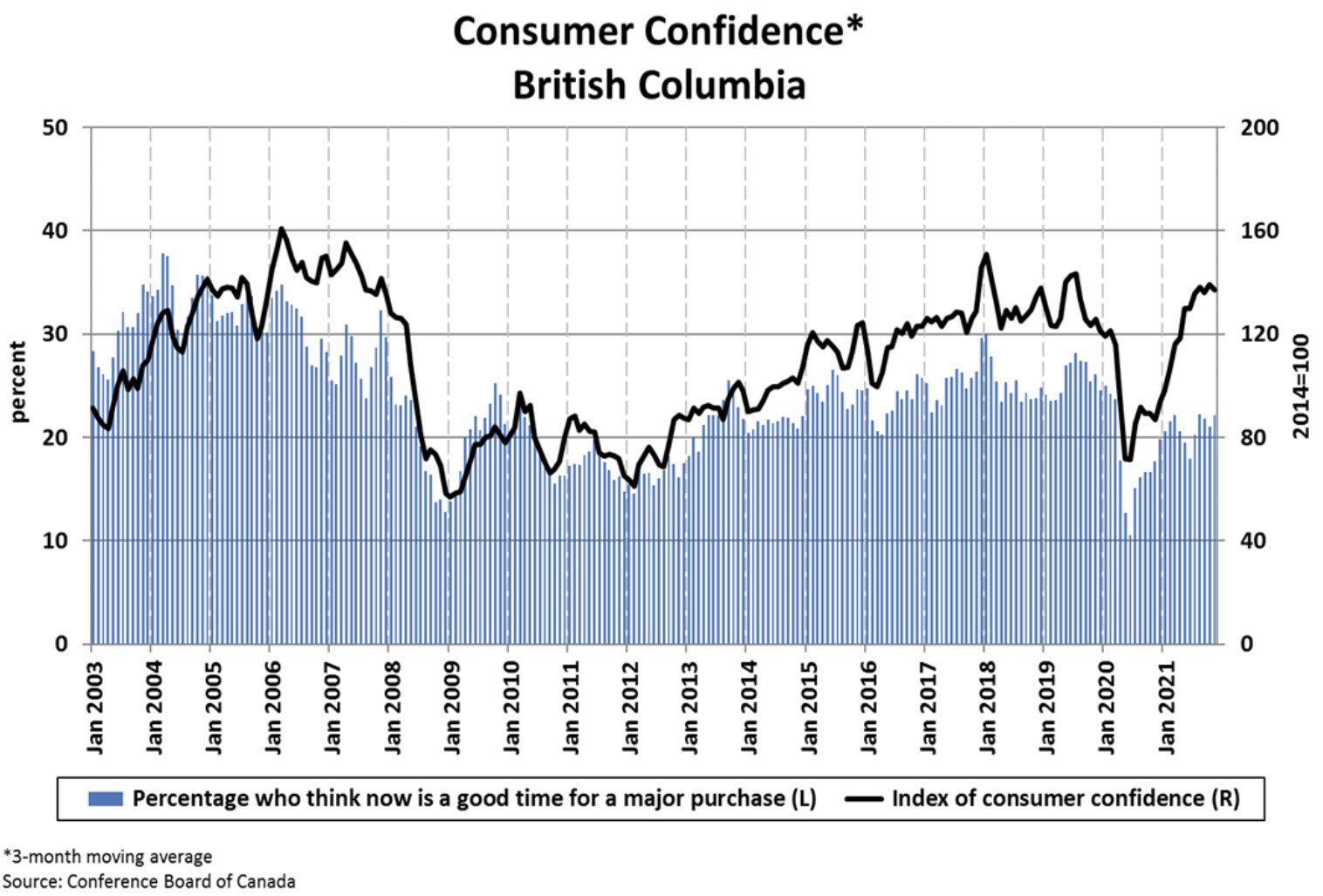

According to the Conference Board of Canada consumer confidence in British Columbia was down in November 2021 and has been trending around the same levels for the past few months.

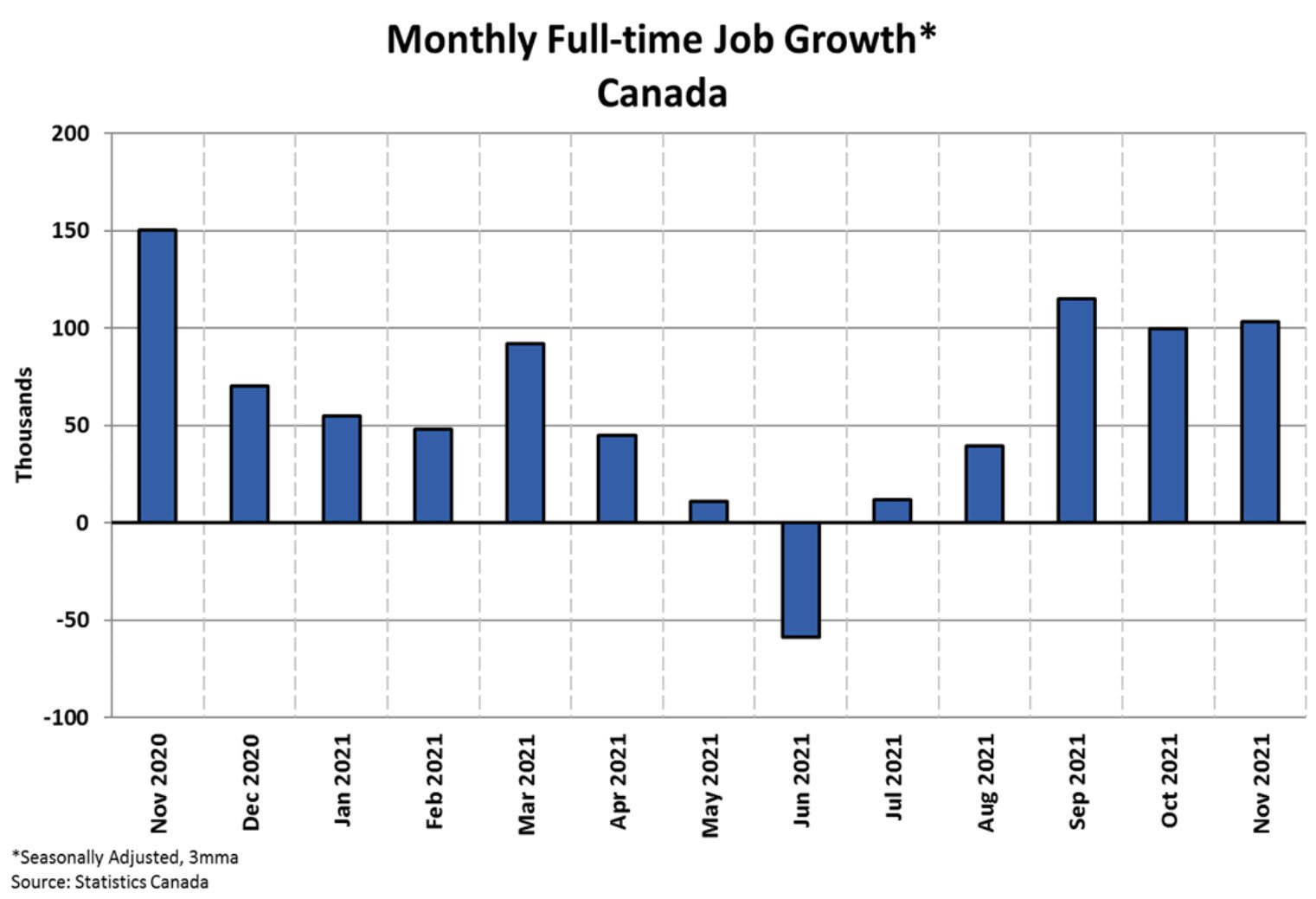

Employment Trends

The unemployment rate in Canada was 6.5% as of November 2021, down 0.4% from the previous month. The unemployment rate stood 6.6% below the peak from June 2020 and is below the long-run average.

There were 103,300 more full-time jobs in November 2021 compared to a month earlier. A gain of 10,800 part-time positions led to an increase of 114,100 total jobs in November.

Full-time employment has recovered since bottoming out in June 2020 and now stands at a record high.

Real Estate forecasting is never easy. With so many factors in play and the pandemic still being unpredictable we will see more of what we went through well into 2022. Some housing segments are not as robust and each area within our market can outperform other areas.

If you have questions or ideas on the information you would like to see in our Market Intelligent Reports, please let us know. Thank you for reading and we wish you a Happy Holiday.

Real Estate Market December 2021