The markets have had significant swings over the last few years, I’ve created a video on why the market did what it did and how it was predictable. Moving forward we can see that things will change back again once rates and confidence stabilize. (see video link at bottom)

The main thing on many buyers minds of course is the rising of rates which has cause the housing market to cool. Bank of Canada raises targets for overnight lending rates to 4.25% in seven consecutive increases since March.

The Bank acknowledged that global inflation remains high and broad-based, reflecting the strength of the global recovery from the pandemic, supply chain disruptions, as well as elevated commodity prices stemming from the war in Ukraine. Financial markets were pricing in at least another 25 to 50 basis points of further interest rate hikes through the third quarter of 2023.

The Bank of Canada indicated that the economy continues to operate in excess demand. Labour markets remain tight, with the demand for goods and services running ahead of the economy’s ability to supply them which continues to put upward pressure on domestic inflation. Despite job vacancies declining from their peak, they remain high, and businesses continue to report widespread labour shortages. This, along with the excess demand created with the full reopening of the economy after the pandemic restrictions, has led to large increases in the prices of both goods and services.

Our market remains in a “wait and see” period where many buyers are sitting on the sidelines. Once inflation starts to stabilize, we will see rate increases slow or stop and this will give buyers pause and instill confidence again when they see that rates are still historically good based on the below trendline. This will cause a rush of buyers that have been waiting to come back into the market, as we still have low inventory this will pose another shortage of homes.

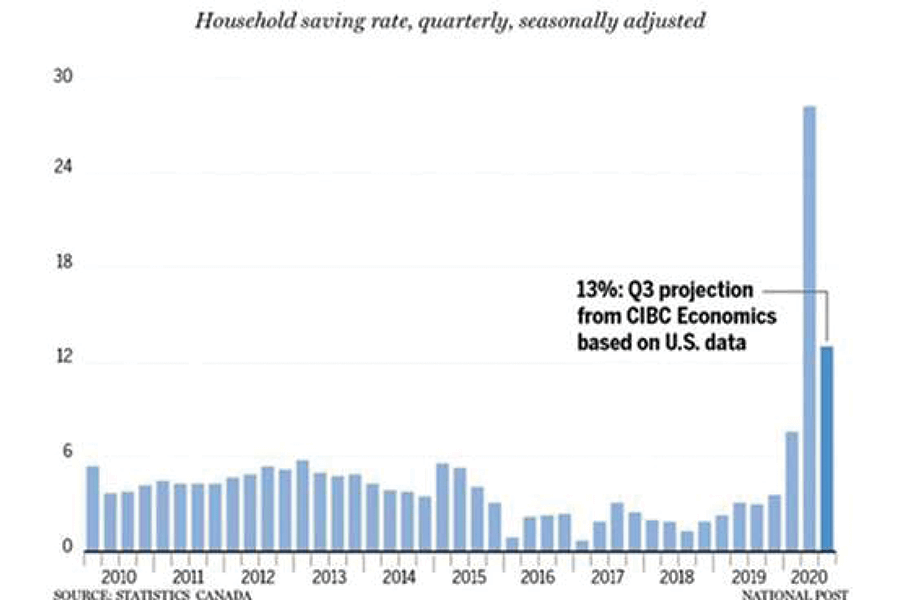

Measuring consumer confidence regarding expectations for their household budget over the next six months, the number of respondents expecting stability fell at the expense of more respondents expecting a deterioration in their household finances. The gap between respondents expressing pessimism over their future financial situation and those expressing optimism has widened sharply in recent months.

Sentiment about making major purchases, like a home or a car, remains at historically subdued levels across the country. The overall percentage of respondents who thought it was a good time to make a major purchase fell again in November, as the number who were uncertain also fell.

Vancouver Island Market:

Last month, 244 single-family homes sold in the Vancouver Island Real Estate Board this indicates a decrease of 30 % from one year ago. The Townhomes category saw 46 units changing hands in November, down 52% from one year ago, however this is also due to low inventory.

There were 1,195 active listings of single-family detached properties last month, compared to 301 in November 2021. It looks as if listings are nearing our 10-year average.

These numbers can be difficult to decipher at times and although the scale of year-over-year price increases has decreased, it still costs more to buy a home than it did a year ago.

Using average prices can tend to show a skewed picture, especially when the number of total sales is low. The reason for this is when you are working with a low number of unit sales to create the averages any extremes can make huge changes in the average. Here are the Benchmark prices for the Vancouver Island area, this is a calculation system that removes the extremes to create more realistic sales numbers.

* Campbell River, the benchmark price of a single-family home hit $679,200 in November, up 1% from the previous year.

* Comox Valley’s year-over-year benchmark price rose by 3% to $807,900.

* Cowichan Valley reported a benchmark price of $793,500, an increase of 5% from November 2021.

* Nanaimo’s benchmark price rose by 6%, reaching $800,100,

* Parksville-Qualicum area saw its benchmark price increase by 2% to $887,000.

* Port Alberni reached $552,200, up 9%t from the previous year.

* For the North Island, the benchmark price of a single-family home rose by 15% to $462,700.

A national look shows a similar trend to our market.

Home sales recorded over Canadian MLS® Systems fell by 3.9% between August and September 2022. From May through August, month-over-month declines have been progressively smaller. The September result marked a slight increase in the current sales slowdown that began with the Bank of Canada’s first rate hike back in March.

While about 60% of all local markets saw sales fall from August to September, the national number was pulled lower by the fact markets with declines included Greater Vancouver, Calgary, the Greater Toronto Area (GTA) and Montreal.

While about 60% of all local markets saw sales fall from August to September, the national number was pulled lower by the fact markets with declines included Greater Vancouver, Calgary, the Greater Toronto Area (GTA) and Montreal.

As we end one of the most challenging markets one thing is important to understand, we are still undersupplied for many types of homes. Vancouver Island remains one of the most sought-after places in Canada and with an aging demographic and lack of inventory we will see prices rebound just as fast, and buyers once again will be asking where all the inventory is. Some developers see this and are preparing for this change. I hope to see a balanced market for everyone and as the pendulum swings it will eventually find balance.