The Canadian housing market will likely face its most important test since the global financial crisis, as low oil prices continue to weigh on Alberta and Saskatchewan, while new down payment rules from Ottawa are expected to take some heat out of both the Ontario and B.C. Real Estate markets.

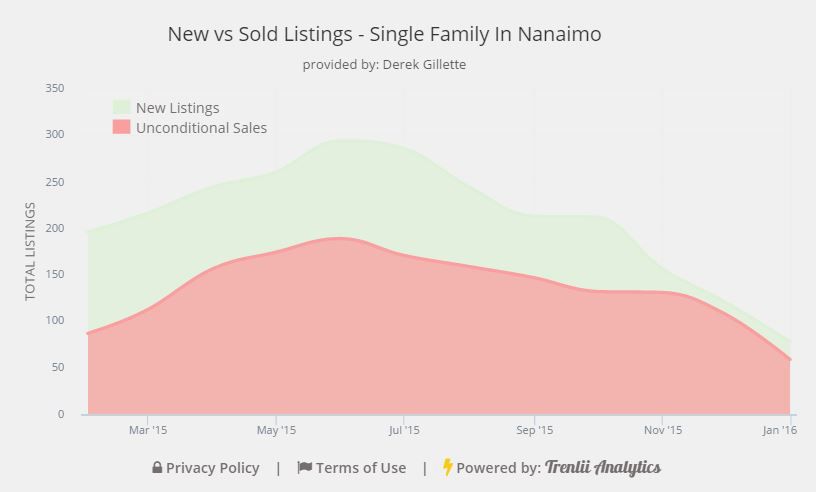

However, we need to keep in mind that Nanaimo has not seen any of the “irrational exuberance” (borrowing a quote from Greenspan in his Dec 5th speech in 1996) that Vancouver or Toronto has witnessed, and in many ways that’s good news. To drill down on our local market, it’s very small in comparison, ending 2015 with around 309 active listings, which is a 10 year low. The highest sales month was May, with 189 sales which was the best month we have seen since 2009, which so happened to also be spurred on by the lowering of interest rates.

2009 and 2015 have many similarities, as both emerged off the heels of a global market slowdown and government intervention, but after 2009 we fell into a 5 year slump with relatively low sales and much higher inventory. As an example, our peak inventory in 2015 was 534 single family listings and in July 2012 it was around 820 with only 100 sales. That put us at around 7+ months of inventory compared to 3 now. The trend that I am watching more closely is the $600,000 + inventory, which is trending up. My feeling is, we will have a strong start to 2016 and need to watch to see the investment we attract from our low Canadian dollar, and see if the impact from other parts of Canada weigh on us in any direct way, but overall I think we still come out ahead in 2016.

If you have any questions about our local real estate market, please let us know or stop in.

As a founder of Trenlii Analytics Inc, currently used by thousands of real estate agents across Canada, Derek’s insights into market trends has helped his clients effectively manage their real estate assets, giving them better forecasting and planning tools.