Welcome back to the Gillette and Associates May 2025 – Real Estate Market Update, we are going to cover the landscape of where the market has came to and where it headed throughout this post.

Nanaimo Market

Let’s start right here in Nanaimo.

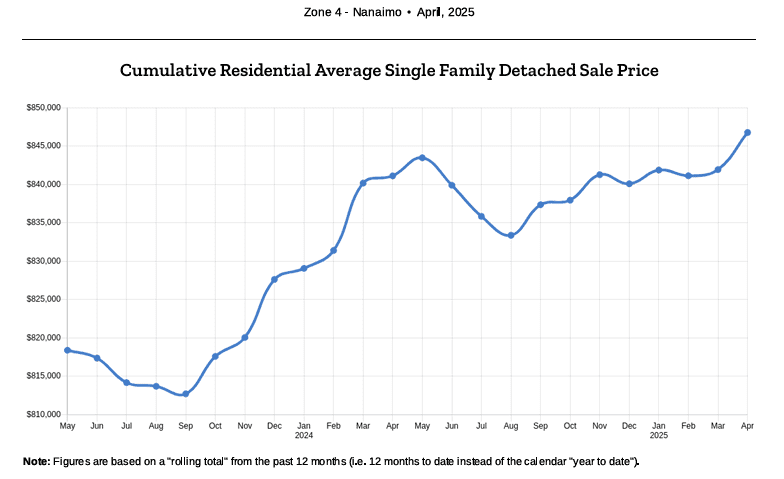

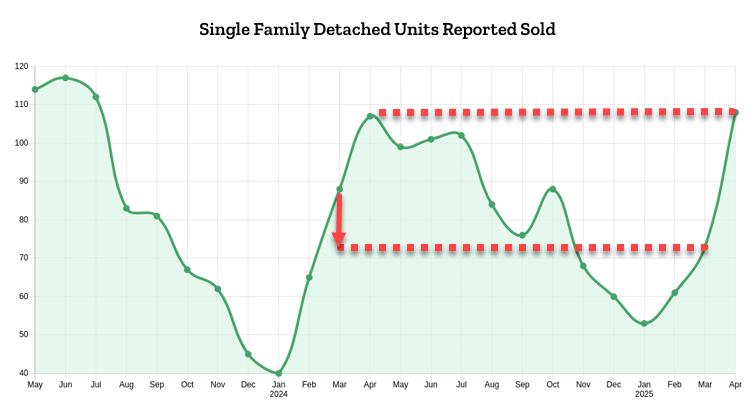

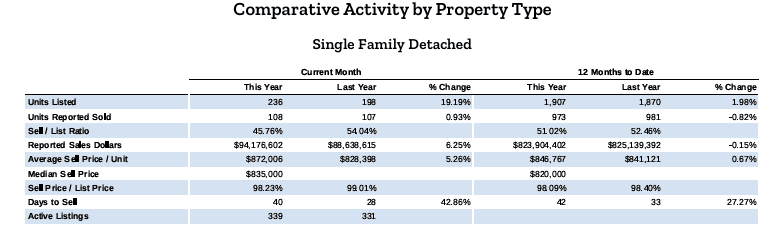

In April, 108 single-family homes sold in the city — nearly identical to the 107 that sold in April 2024. and a strong bump from March’s 73 sales. It’s a clear sign that the spring market is heating up.

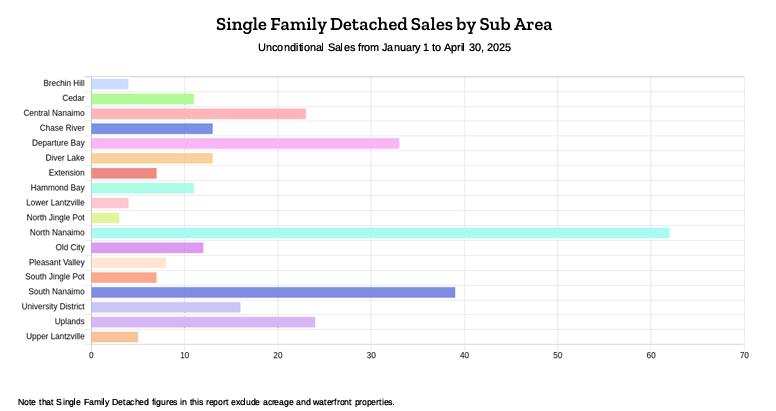

The average sale price in Nanaimo reached $872,006, which is up over 5% compared to last year. The median sale price was $835,000. Homes under $900,000 in neighborhoods like North Nanaimo, Uplands, and Diver Lake are seeing fast movement, especially if they show well and are priced competitively. Inventory is growing, but well-presented homes are still selling in under two weeks.

Buyer confidence is rising again. We’re seeing activity from upsizers, early retirees, and investors looking for mortgage-helper potential. That said, unique homes like acreages or those in wildfire zones are facing more scrutiny — especially when it comes to insurance.

Vancouver Island Market

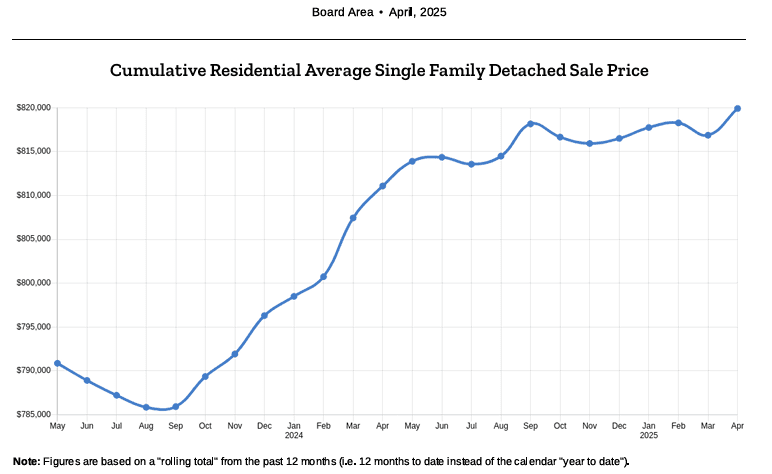

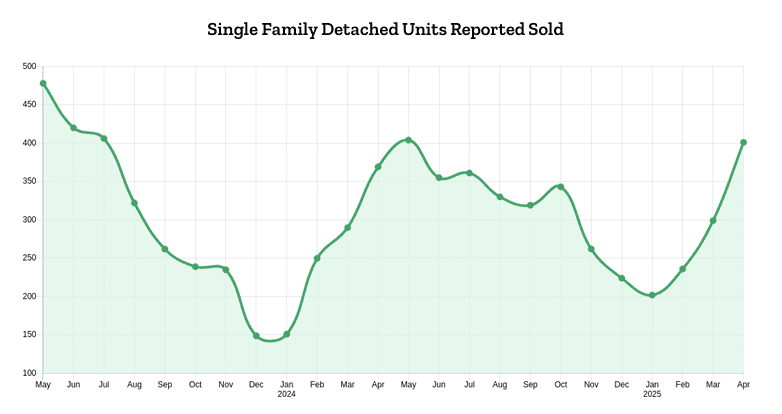

In April, 401 single-family homes sold across the VIREB region — an 8.67% increase from this time last year. Every major zone saw activity pick up. Campbell River posted 2%. The Comox Valley had 82 sales and led the Island in price growth at over 9%. Cowichan Valley recorded, up slightly in both volume and price. Parksville and Port Alberni saw modest price declines.

Board-wide, the average sale price rose to $840,508 — up nearly 4% from last year. This tells us the Island market is gaining momentum again, but still offering balance.

Broader Economics Market

The Bank of Canada held its key rate steady at 2.75% in April. Bond yields are trending higher, and as a result, we’re seeing fixed mortgage rates move slightly up — particularly for insured and shorter-term fixed products. This is bringing buyers off the sidelines with the fear that rates may continue up.

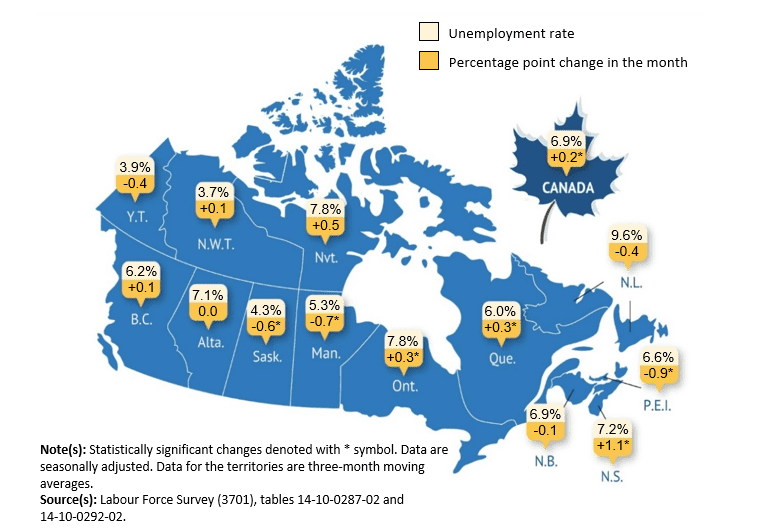

Provincial Unemployment Rate April 2025

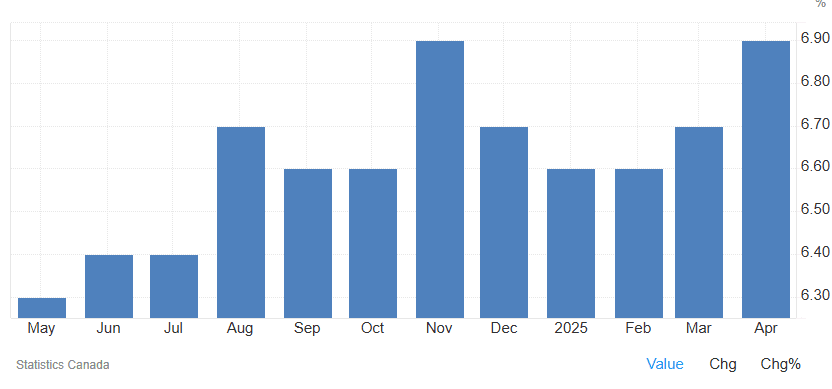

Canada Unemployment Rate May 2024 – April 2025

10-Year Bond Yield: ~3.20%

New housing starts were down 3.3% in March, with developers pulling back slightly on multi-family builds. Single-family construction remains stable.

One important stat to watch: the national unemployment rate rose to 6.7% in March. That uptick reflects broader uncertainty in the economy, especially in construction, retail, and small business sectors. While not alarming yet, it’s something we’re keeping an eye on heading into summer.

As for national home prices — we’re holding off on that data until the Canadian Real Estate Association releases updated figures on May 16th. We’ll update you as soon as those numbers come in.

Summary

So, here’s the bottom line for May:

In Nanaimo, the market is strong and stable. Prices are climbing modestly, and well-prepared listings are selling quickly. Across the Island, spring activity is picking up pace. And economically, while there are a few caution signs — like higher unemployment and fewer housing starts — interest rate stability and better mortgage rates are fueling buyer confidence again.

If you’re thinking about making a move this season — whether it’s buying, selling, or just exploring your options — now is the time to get good advice and stay ahead of the curve.

Find more information on the market through our monthly blog.