Average Home Price

The average sale price in Nanaimo has increased by 9% from October 2022. This rise might suggest a rapid increase in housing demand, similar to the pandemic housing market boom. However, this increase is not the same as during the pandemic. To understand why we must consider other data points detailed in the Nanaimo Market Update.

Days on Nanaimo Market

Properties in October stayed on the market for an average of 42 days, up from 35 days in September. This suggests that buyers are not acting with the same urgency as in recent years. Homes are taking longer to sell, resulting in less activity and more price reductions by sellers. The quickest property sale in October was 7 days, while the longest was 168 days. This variation indicates that while some properties sell quickly, the market overall is slower.

Sales and Inventory

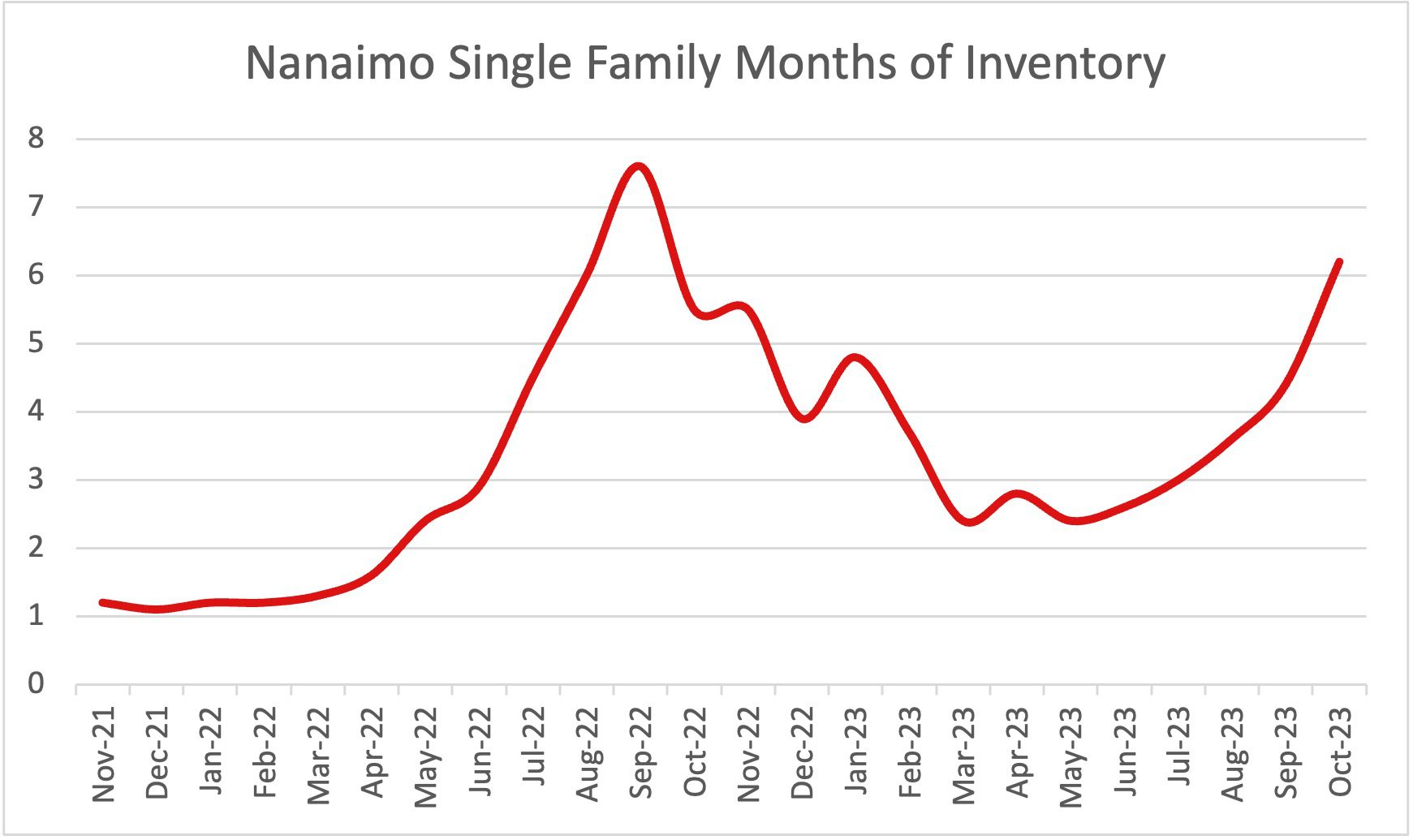

To forecast the market accurately, we need to monitor the number of transactions and new homes on the Nanaimo market. This data helps us compare different periods and determine if the inventory meets the demand. By calculating the months of inventory, we can assess whether there is excess inventory.

More Inventory and Buyer Choice

More inventory gives buyers more choices, leading to longer days on the market. Buyers can look at more properties, schedule multiple showings, and take longer before making an offer.

The number of new listings each month has remained consistent throughout the fall. In October, Nanaimo had 156 new single-family home listings, down 19% from a year ago. Transactions also dropped by about 7%, causing a spike in the months of inventory. In September, there were 4.4 months of inventory; in October, it increased to 6.2 months. Typically, this would cause prices to fall due to more supply than demand. Despite this, the average price has increased, necessitating a closer look at the reasons behind this rise.

Analyzing Nanaimo Market Transactions

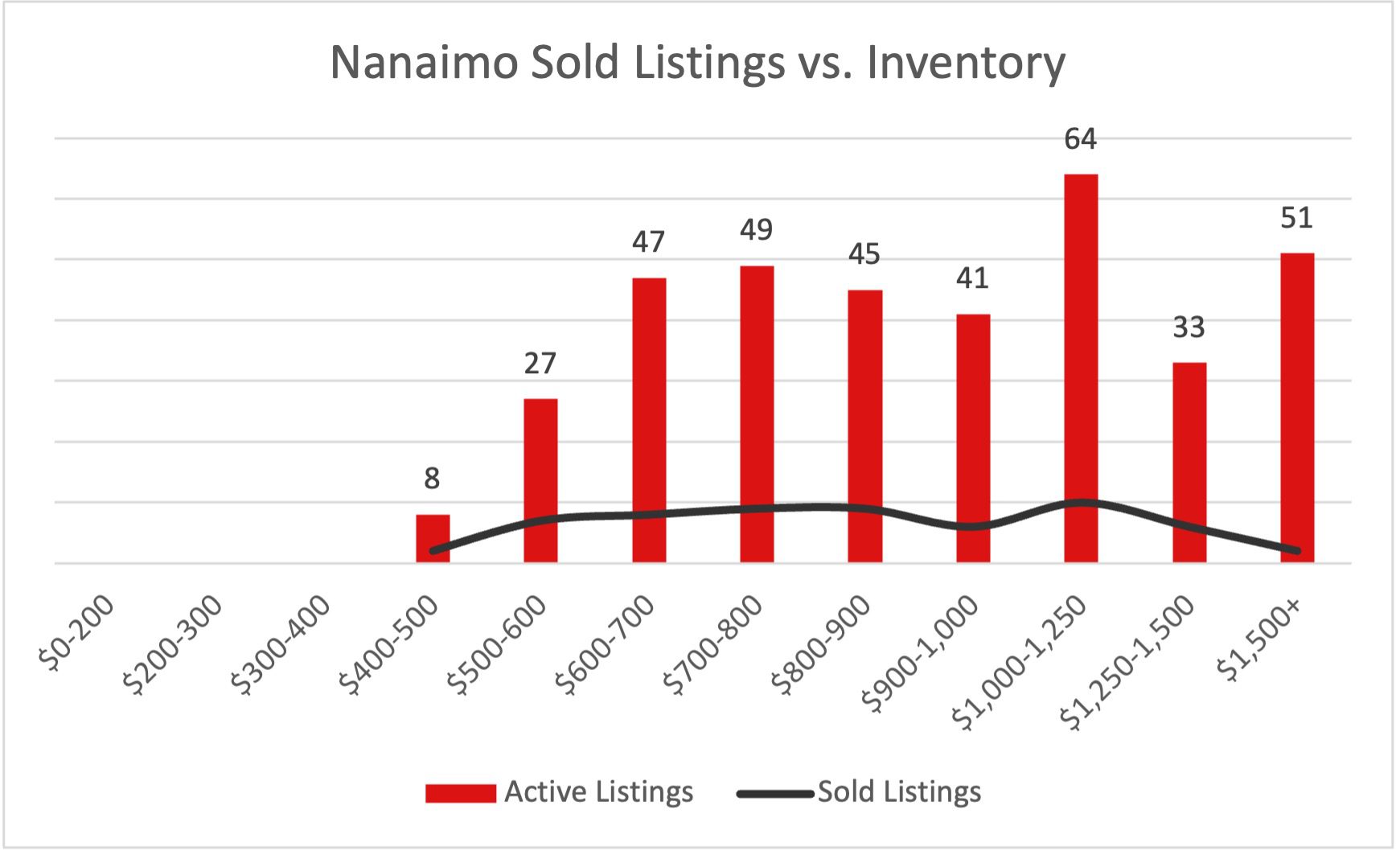

Analyzing October transactions reveals that the increase in average price is due to the broader economic climate. With fewer sales, the market shifted towards higher-priced homes. Higher interest rates are pricing out buyers at the lower end, who either stop searching or wait for more affordable homes under $700,000. In contrast, buyers with higher net worth and liquid assets are less affected by interest rates. They often have larger down payments or equity from previous homes, leading to more sales in the $1-1.25 million range, compared to the previous $800-900K range.

With this shift in the market and less home being sold in the lower price points, an increase to the average price is to be expected and months like these are a great reminder that while the average price can be an important value to look at, it is not always the best indicator of where a market is heading.