Hello everyone! Derek Gillette here with DG & Associates. As we move closer to the end of 2024, I wanted to take a moment to share my perspective on the current real estate landscape and what lies ahead with the November 2024 Market Stats. I know that many of you have questions about where the market is going – especially after the rollercoaster we’ve been through with interest rates, consumer confidence shifts, and economic ups and downs.

In this blog, I’ll cover what we’re seeing in our local Vancouver Island and Nanaimo markets and explore the broader trends across Canada. We’ll look at interest rates, consumer confidence, and what these factors might mean for the months ahead. My goal is to give you a clear, grounded view of where things stand, as well as an optimistic look at the opportunities that could emerge as we head into spring. So, let’s dive into the data and trends driving our market and how they could impact your real estate decisions in 2025.

1. Vancouver Island Market Overview

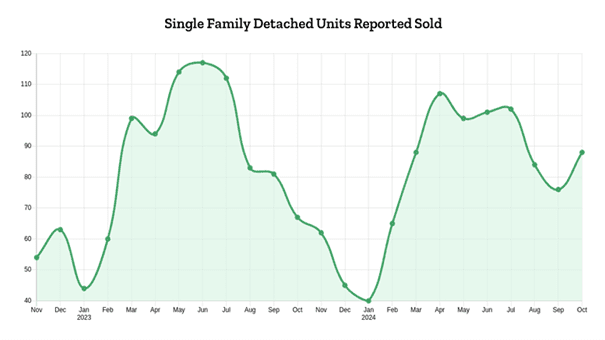

· Strong Sales and Rising Inventory: Vancouver Island has seen a resurgence in activity, with a 42% increase in unit sales and a 12% rise in active listings in October 2024, compared to last year. This growth reflects the resilience of our local market, bolstered by a strong economy that outpaces much of the province.

· Single-Family Homes Leading the Charge: Our single-family home segment saw the highest year-over-year growth, with sales up 45%. Condos and townhomes are also performing well, and inventory has been steadily increasing to meet demand. For buyers, this means more options; for sellers, it means a more balanced market where properties are moving at a steady pace.

2. Nanaimo’s Resilience and Pricing

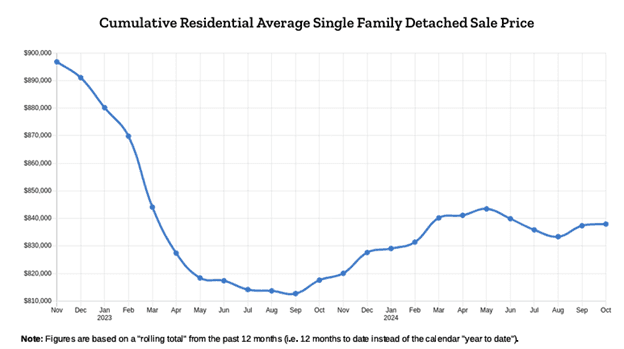

· Stable Demand and Pricing: In Nanaimo, we’re seeing a stable market environment, with the benchmark price for single-family homes at around $809,000. This is only a slight decrease from last year, reflecting balanced supply and demand. For those considering buying or selling in Nanaimo, this stability means less volatility and the opportunity for smart, well-timed decisions.

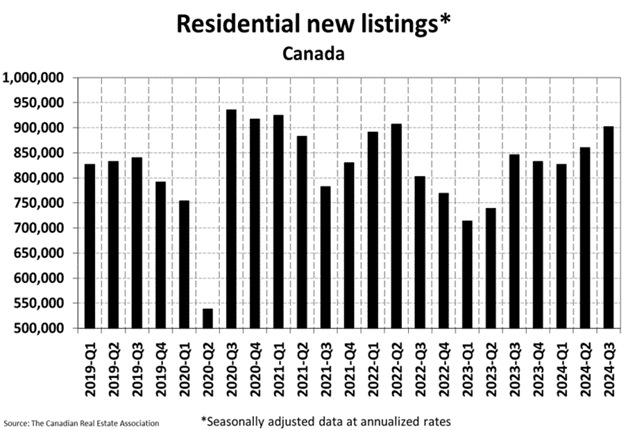

3. Broader Canadian Market Context

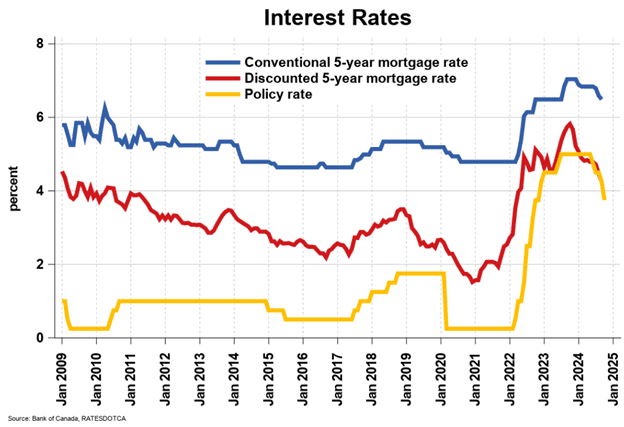

Interest Rate Cuts Providing a Boost: Nationally, the Bank of Canada’s rate cuts have encouraged a modest increase in sales, with a 1.9% rise in September. This marks the third consecutive month of growth, especially in key areas like Toronto, Vancouver, and Montreal. However, some buyers are holding off, anticipating further rate cuts, which could make the spring market even more active.

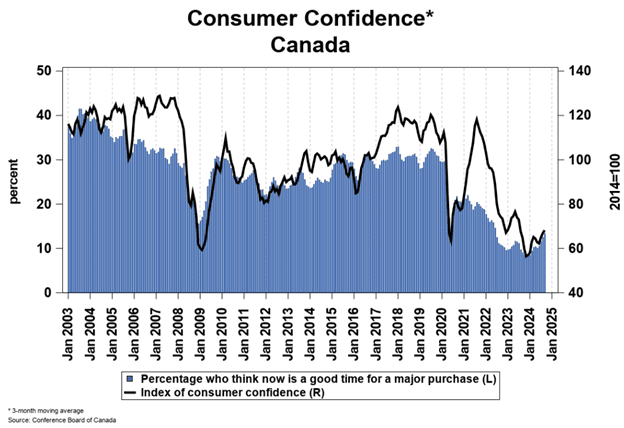

Renewed Consumer Confidence: Following a dip last year, consumer confidence is showing signs of recovery. Canadians are feeling more secure in their financial outlook, which is a positive signal for the housing market as we move into 2025.

4. Economic Trends Affecting Real Estate

Moderate Economic Growth and Soft Employment Market: Canada’s GDP growth is projected at 1.75% for the second half of 2024, with a slightly stronger forecast for next year. Although employment remains soft, steady population growth continues to drive demand. This points to a real estate market that’s stabilizing, with gradual, sustainable growth rather than sudden shifts.

5. Positive Outlook for Spring 2025

An Optimistic Market Outlook: As spring approaches, we’re optimistic about the possibilities. Lower mortgage rates, policy changes favoring first-time buyers, and a balanced inventory level suggest a more buoyant market. We expect 2024 to close on a positive note, with around 7,400 sales on Vancouver Island – a significant increase from last year.

Price Stability with Potential Gains: In British Columbia overall, prices are projected to rise modestly by around 3.3% in 2025. This outlook reflects a balanced market that can absorb the increase in demand without extreme price swings.

At DG & Associates, we’re excited about what the coming months may bring. We believe the spring market will offer valuable opportunities for both buyers and sellers, with a solid foundation for growth as rates continue to ease. As always, we’re here to guide you through every step of your real estate journey and to ensure you’re equipped with the latest insights and advice. Let’s make 2025 a successful year together!