We have had some price increases in the middle price ranges due to a tighter inventory and pent up demand. We do have to look past these past months with the real market test coming in autumn and winter seasons. With the travel bans, foreign investment in Real Estate could slow and AirBnB investments may encounter cashflow problems.

In our current economy mortgage deferral programs have helped offset the economic shock to households across the country however the end of these programs is just around the corner which could trigger more supply, something to consider for those that need to sell.

The overall economy is still struggling with elevated unemployment and businesses hesitant to spend. So far, our market has shrugged this off, maybe because of our affordability and our desirable lifestyle.

One of the factors that might help stimulate sales is that our National mortgage rates could drop even further than the current 1.69% fixed rates we’re seeing. Rates are expected to remain low for years however to offset this we have seen a lull in immigration which could significantly impact the Canadian market.

Prior to the pandemic, Canada enjoyed high levels of immigration, low unemployment and low interest rates all conspiring to move housing prices higher. Our concern is our increasing household credit market debt as a proportion of household disposable income up to 176.9 per cent from 175.6 per cent. In other words, there was $1.77 in credit market debt for every dollar of household disposable income.

In our local market a total of 892 units sold in July 2020, down four per cent from the 931 sales posted in July 2019. Breaking down those sales by category, 574 single-family detached properties sold on the MLS® System last month compared to 573 in June 2020 and 554 in July 2019. Sales of condo apartments dipped by 14 per cent year over year while row/townhouse sales dropped by 16 per cent.

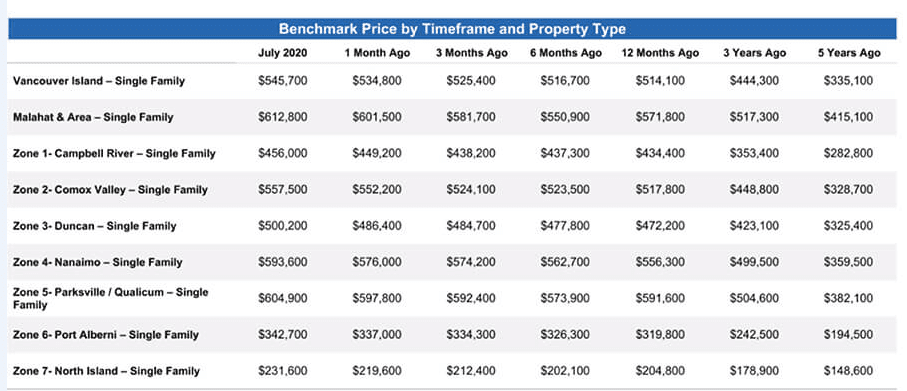

The benchmark price of a single-family home board-wide was $545,700 in July, an increase of six per cent from the previous year and two per cent higher than in June. (Benchmark pricing tracks the value of a typical home in the reported area.) In the apartment category, the year-over-year benchmark price rose by four per cent, hitting $312,800 and up marginally from June. The benchmark price of a townhouse in July rose by four per cent year over year, climbing to $425,800 but down slightly from June.

Campbell River, the benchmark price of a single-family home last month was $456,000, an increase of five per cent over last year. In the Comox Valley, the benchmark price reached $557,500, up by eight per cent from one year ago. Duncan reported a benchmark price of $500,200, an increase of six per cent from July 2019. Nanaimo’s benchmark price rose by seven per cent to $593,600 in July, while the Parksville-Qualicum area saw its benchmark price increase by two per cent to $604,900. The cost of a benchmark single-family home in Port Alberni reached $342,700 in July, a seven per cent increase from one year ago.

I continue to monitor the market closely but I don’t find it that difficult to predict what we will see. Last week I had my network meetings with my national group and it seems to be a consistent trend across the board with some areas like Calgary lagging behind. I interviewed an agent in California who said their market is still fairly active in spite of the uptick in Covid. It comes back to the balancing of personal debt and the low interest rate environment we are experiencing, which we may never experience again.

If you want to get the facts and predictions on the local market give me a call. If you’re thinking of selling now is definitely the time.

Thanks,

Derek