Fall Real Estate Market Update – Vancouver Island

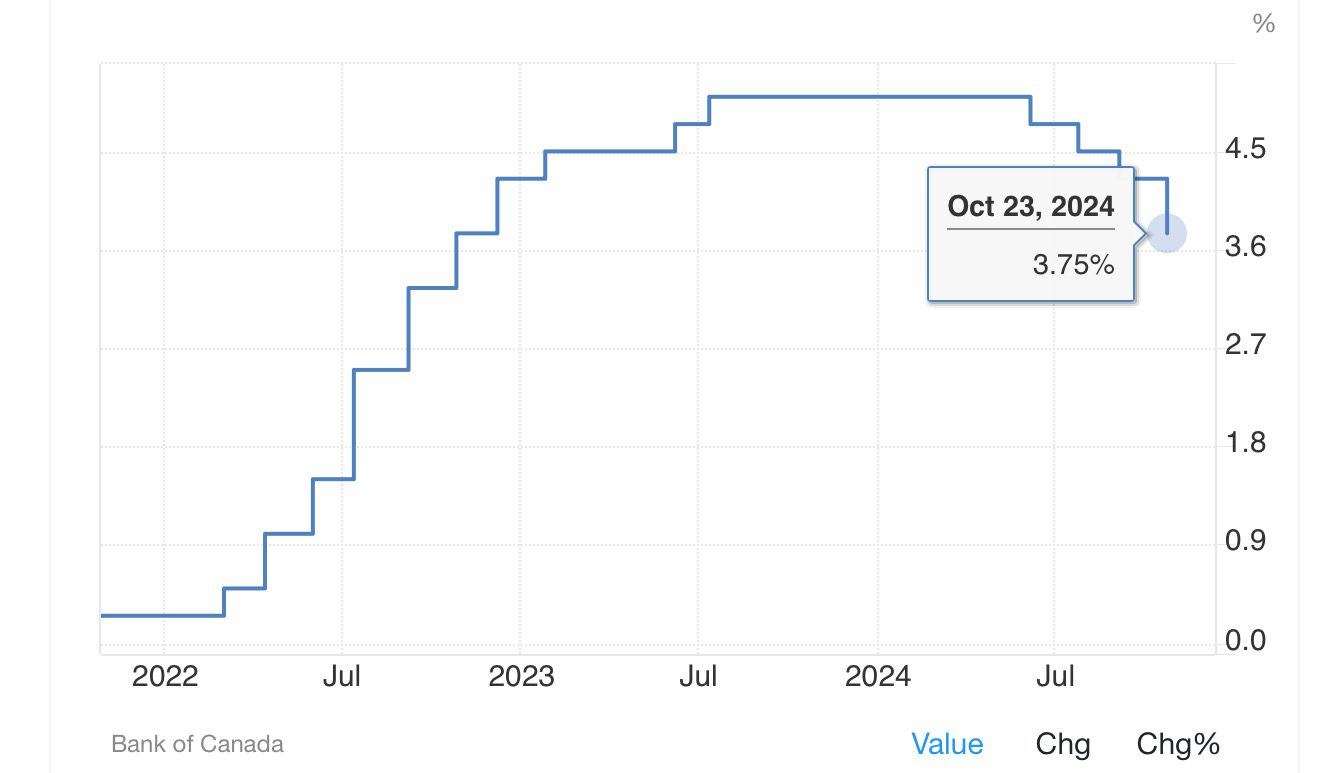

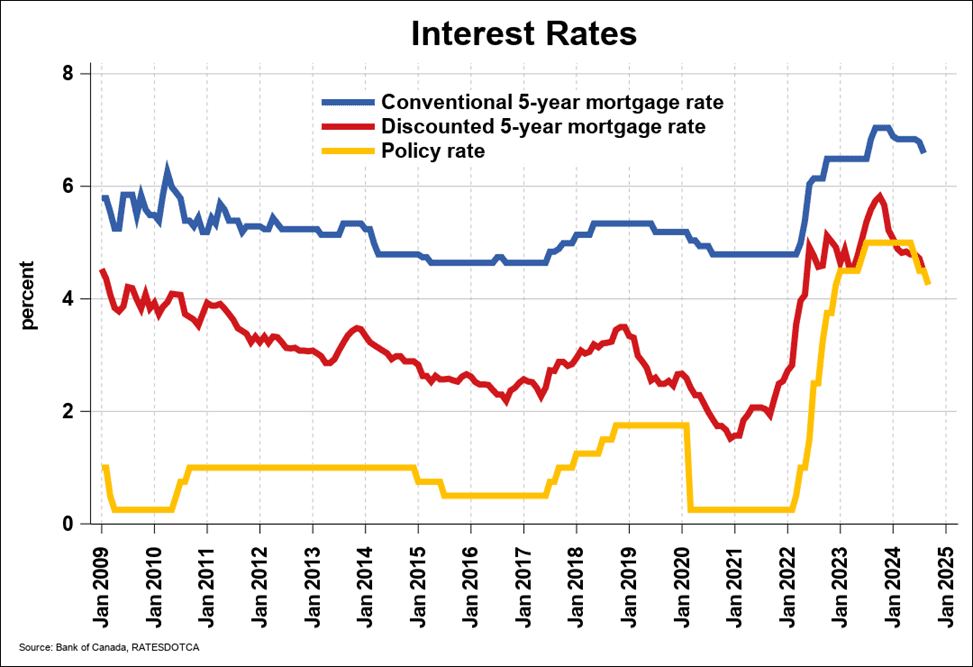

The big story right now is the Bank of Canada’s half-point interest rate cut. Dropping the overnight rate by 50 basis points As expected, the Bank of Canada cut its key interest rate by 50bps to 3.75% in its October 2024 decision, with plans to continue lowering rates if economic conditions follow the current trend.

This marks an accelerated pace following three 25bps cuts, in response to slowing inflation. In September, inflation dropped to 1.6%, falling below the 2% target for the first time in three years. is significant, and it’s going to have a big impact on our market moving forward. This could very well signal the bottom of the market, and we’re expecting buyers to start taking advantage of these lower rates as they settle in.

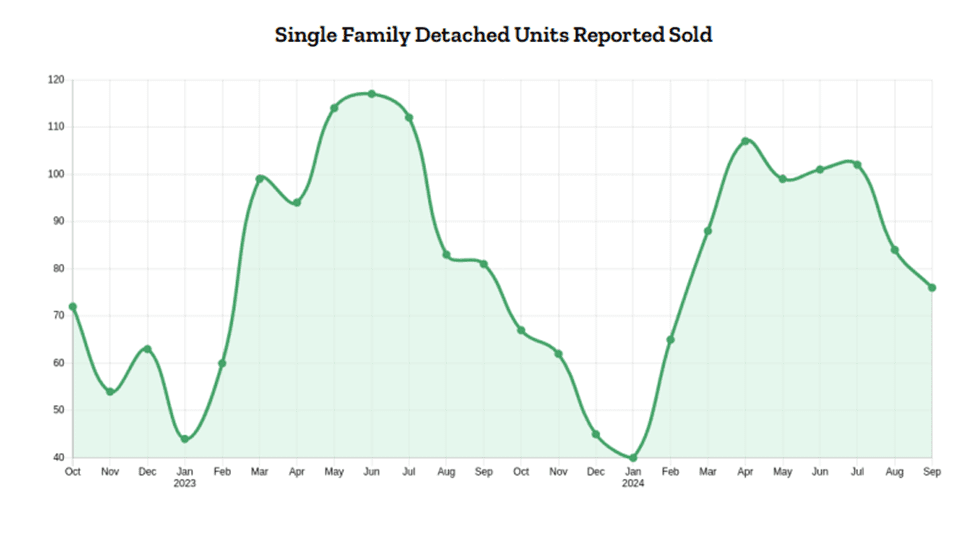

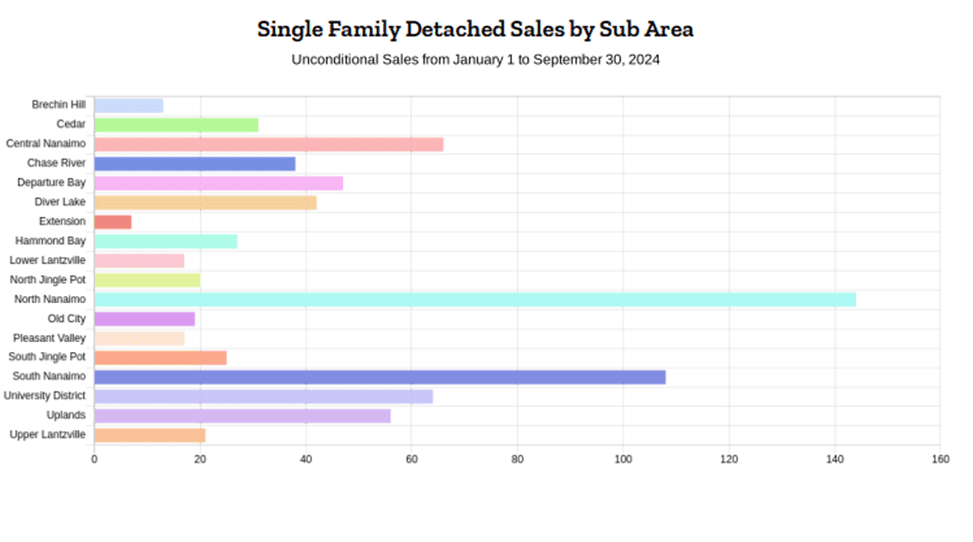

September 2024 brought a burst of activity to the Vancouver Island real estate market, showing the energy typical of a spring season. A total of 637 properties were sold, and 4,465 active listings were available across all property types on the MLS® system. This represents a 16% rise in sales and a 24% increase in listings compared to September 2023.

- Single-family homes saw 320 sales, a 22% increase year-over-year, though slightly lower than in August by 4%.

- Condo apartment sales dropped to 69 units, marking a 19% decrease from last year and a slight 1% decline from August.

- Townhouses were highly sought after, with 93 sales, up 31% from last year and a 35% jump from August.

Inventory levels rose across the board:

- Single-family homes: 1,586 active listings (up from 1,173 last year).

- Condo listings: 410 (up from 305).

- Townhouses: 335 listings (up from 239).

With the highest inventory in five years, plus falling inflation and interest rate cuts, buyers have an excellent opportunity—especially in the condo and townhouse markets. Sellers are adjusting prices, with reductions becoming more common, though overpriced properties remain on the market longer.

Pricing Trends and Regional Insights

- Condo apartments: $403,600 (down 2% year-over-year but showing a small increase from August).

- Condo apartments: $403,600 (down 2% year-over-year but showing a small increase from August).

- Townhouses: $545,400 (down 1% from last year but slightly higher than the previous month).

Regionally:

- Campbell River: Prices rose 3% to $694,700.

- Comox Valley: A slight decline in prices.

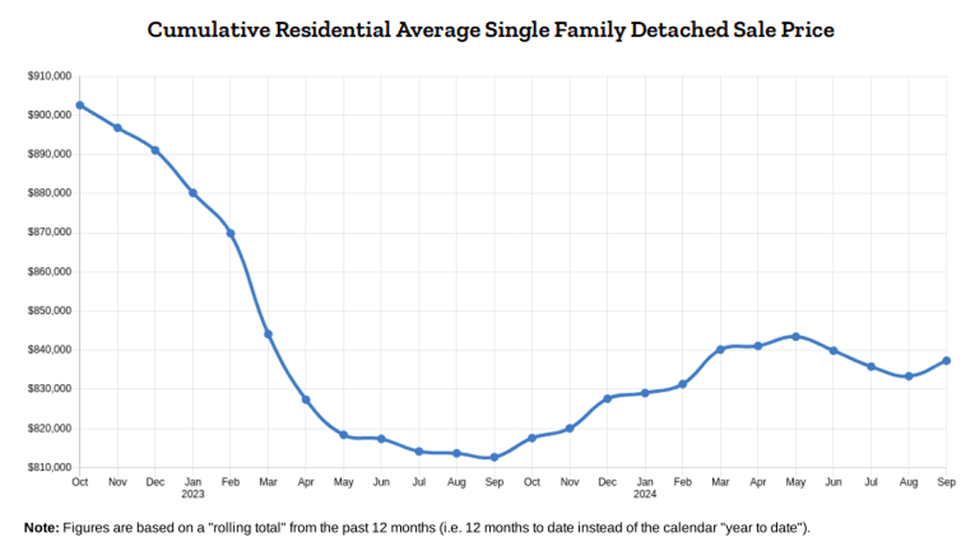

- Nanaimo: Prices reached $810,800.

- Parksville-Qualicum: Prices increased by 1%.

- North Island: Single-family home prices were up by 4%.

Overall, the market’s uptick in activity and inventory offers great potential for both buyers and sellers. The key will be aligning on pricing as conditions continue to shift.

National Home Sales See Modest Increase in September

National Market Overview – September 2024

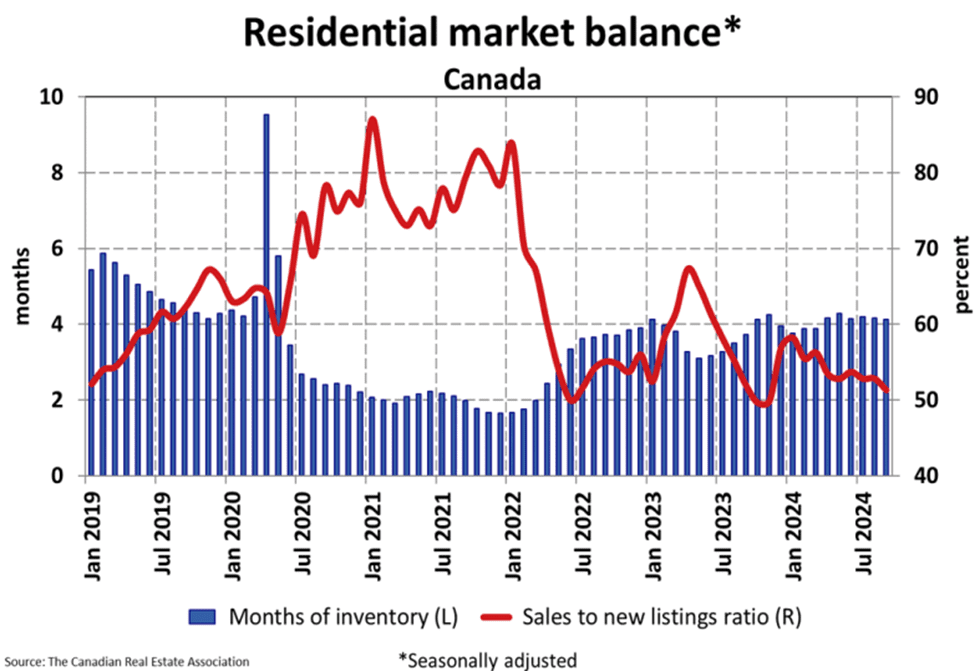

Nationally, Canadian home sales across MLS® Systems increased 1.9% from August, reaching their highest level since July 2023. This continued growth follows the Bank of Canada’s third interest rate cut, boosting sales in key markets like Toronto, Vancouver, and Victoria.

Key Highlights

- Sales were 6.9% higher compared to September 2023.

- New listings rose 4.9% from the previous month.

- The MLS® Home Price Index edged up 0.1%, though prices remain 3.3% lower than last year.

- The national average sale price increased 2.1% year-over-year.

- There were 185,427 properties listed for sale on all Canadian MLS® Systems at the end of September 2024, up 16.8% from a year earlier but still below historical averages of around 200,000 listings for that time of the year.

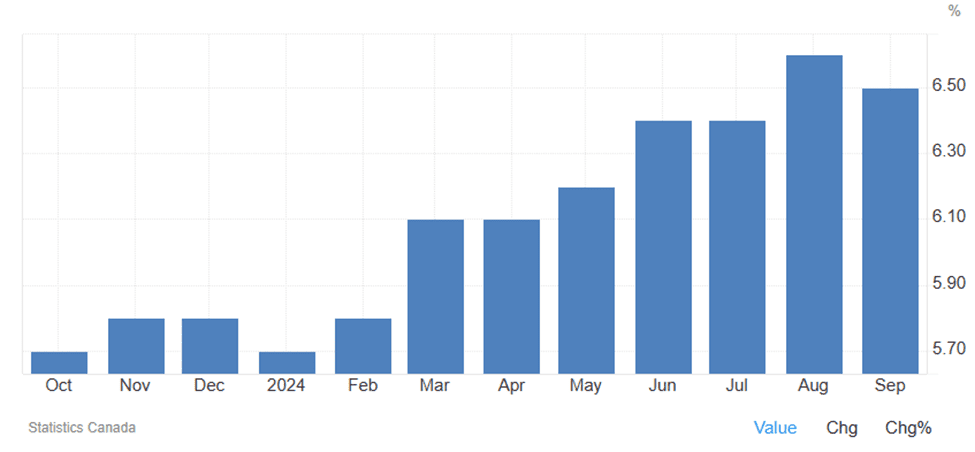

- The unemployment rate in Canada was 6.5% as of September 2024, unchanged from the previous month. The unemployment rate stood 6.9% below the peak in June 2020 and is below the long-run average.

- There were 43,300 more full-time jobs in September 2024 compared to a month earlier. A loss of 21,300 part-time positions led to an increase of 22,000 total jobs in September.

- Full-time employment has recovered since reaching a bottom in August 2022 and now stands at a record high.

Quick comparison between Vancouver Island real Estate market Vs the National market.

Both the Vancouver Island and national real estate markets are seeing increased activity compared to last year, largely driven by interest rate cuts. However, while the national market saw a modest rise in home sales between August and September 2024, Vancouver Island experienced a “burst of activity” more typical of the spring season.

Here’s a closer look at the key differences:

Sales Activity:

- Vancouver Island: 637 properties sold in September 2024, a 16% year-over-year increase.

- Canada: Home sales rose 1.9% from August to September 2024, marking a 6.9% increase year-over-year and reaching the highest level since July 2023.

Listings:

- Vancouver Island: 4,465 active listings in September 2024, up 24% from last year, representing the highest inventory level in five years.

- Canada: 185,427 properties listed for sale by the end of September 2024, a 16.8% year-over-year increase, though still below historical averages for this time of year.

Pricing:

- Vancouver Island: Benchmark prices for single-family homes are slightly up year-over-year but down 1% from August. Condo prices fell 2% year-over-year but rose slightly from August, while townhouse prices dipped 1% year-over-year but edged up from the previous month.

- Canada: The MLS® Home Price Index rose 0.1% month-over-month, though it remains 3.3% lower than last year. The national average sale price climbed 2.1% year-over-year.

While the national market is showing steady signs of recovery, Vancouver Island is experiencing a more pronounced surge, especially in the townhouse sector. High inventory levels on the Island are attracting buyers who are drawn to the increased options and potential for better deals.

Bank of Canada Interest Rate Cuts

On September 4, 2024, the Bank of Canada announced its third rate cut, reducing the overnight lending rate to 4.25%. Despite improved economic performance earlier this year, housing costs remain a driver of inflation, which is easing but still affecting affordability. Future interest rate decisions will hinge on inflation data, with the next update expected on October 23.

As we move deeper into fall, the current market conditions present an exciting window of opportunity for buyers and sellers alike. With rising inventory levels, interest rate cuts making financing more attractive, and inflation starting to stabilize, this is an ideal moment to take action. Whether you’re looking to find your dream home or make a strategic move, now is the time to capitalize on these favorable conditions and secure your place in Vancouver Island’s evolving real estate market. If you are looking for a more detailed analysis please let us know.