Vancouver Island Real estate overview

It’s time for our Vancouver Island June Market Recap, covering the Canadian economy and real estate trends.

Heads-up: new stats will be out next week, and we’ll send you an update then. April was a bustling month for us, with several multiple offers flying around. We’re also keeping an eye on the Bank of Canada’s interest rate decision on June 5th. With Canada’s economy showing signs of slowing, there’s a possibility they might break from the Federal Reserve’s stance.

Now, onto the numbers! The Vancouver Island Real Estate Board (VIREB) recorded 741 unit sales across all property types in April 2024. Here’s a quick breakdown:

Single-family homes: 376 sold, down 2% year-over-year but up 29% from March.

Condo apartments: 75 sold, down 1% year-over-year and down 11% from March.

Row/townhouses: 83 sold, down 2% year-over-year and up 1% from March.

Active listings have seen a healthy boost:

Single-family homes: 1,271 listings, up from 956 last year.

Condo apartments: 381 listings, up from 304 last April.

Row/townhouses: 368 listings, compared to 246 last year.

VIREB’s Chief Executive Officer notes that our spring market, which typically starts waking up in February, has finally sprung to life. “Sales are up from March, and REALTORS® are showing a lot of homes. More inventory means more choices for buyers, but sellers also need somewhere to go when their home is purchased. It’s a win-win situation all around.”

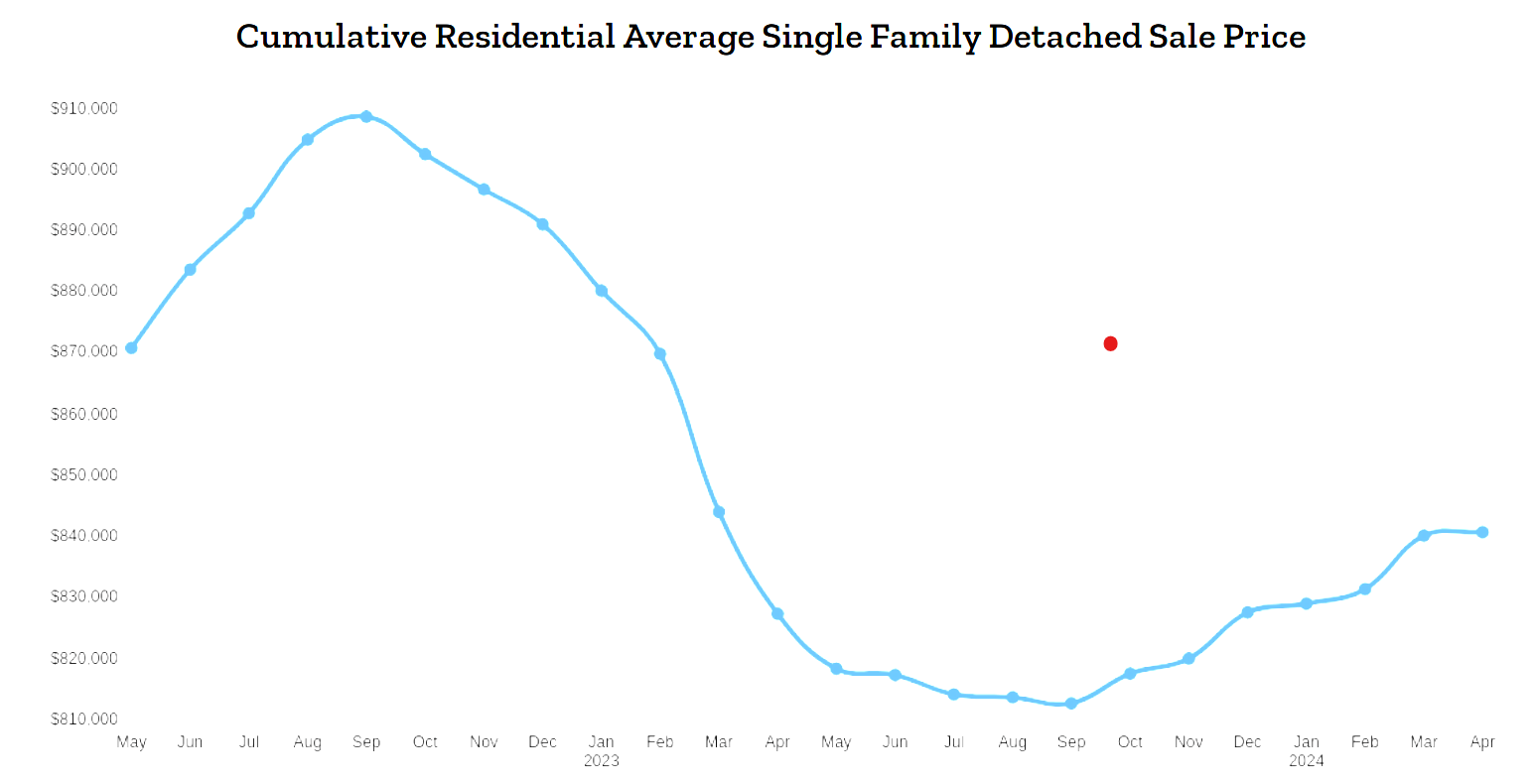

Here are the benchmark prices for April 2024:

Single-family home: $774,700, up 5% year-over-year and up 1% from March.

Condo apartment: $395,300, up 2% year-over-year and a slight increase from March.

Townhouse: $545,100, up 2% year-over-year and $100 lower than March.

Canada’s Real Estate Snapshot

Home Sales and Listings in April 2024

April showers may bring May flowers, but in the Canadian real estate market, they also brought a dip in home sales. Home sales activity recorded over Canadian MLS® Systems fell by 1.7% between March and April 2024, positioning itself just below the decade’s average for this time of year. Meanwhile, the number of newly listed homes rose by 2.8% on a month-over-month basis. This surge in listings combined with slower sales led to a 6.5% increase in the total number of properties on the market—the highest level since the pre-COVID-19 days.

Market Dynamics

The uptick in new listings and the simultaneous cooling of sales activity reflect a significant shift from the previous year. As Shaun Cathcart, CREA’s Senior Economist, aptly put it, “April 2023 was characterized by a surge of buyers re-entering a market with new listings at 20-year lows, whereas this spring has been the opposite, with a healthier number of properties to choose from but less enthusiasm on the demand side.” This year’s spring market has presented potential buyers with a wider array of choices, yet the appetite for snapping up these homes seems to have waned.

Real Estate Implications

For real estate professionals, these trends indicate a nuanced market landscape. The increase in property listings is a positive sign for buyers, providing more options and potentially leading to less competitive bidding wars. However, the dip in sales suggests that buyers may be more cautious, possibly due to rising interest rates, economic uncertainty, or other factors impacting consumer confidence.

A look at Canada

The Vancouver Island June Market Recap shows that the Canadian real estate market in April 2024 reflects a tale of two springs: an abundance of new listings paired with a surprising reluctance among buyers to make a move. As the market continues to evolve, real estate professionals should prepare to navigate these changing dynamics, offering strategic advice and insights to clients looking to make informed decisions.

Vancouver Island June Market Recap

With sales down and new listings up in April, the national sales-to-new listings ratio eased to 53.4%. The long-term average for the national sales-to-new listings ratio is 55%. A sales-to-new listings ratio between 45% and 65% is generally consistent with balanced housing market conditions, with readings above and below this range indicating sellers’ and buyers’ markets, respectively.

There were 4.2 months of inventory on a national basis at the end of April 2024, up from 3.9 months at the end of March and the highest level since the onset of the pandemic. The long-term average is about five months of inventory.

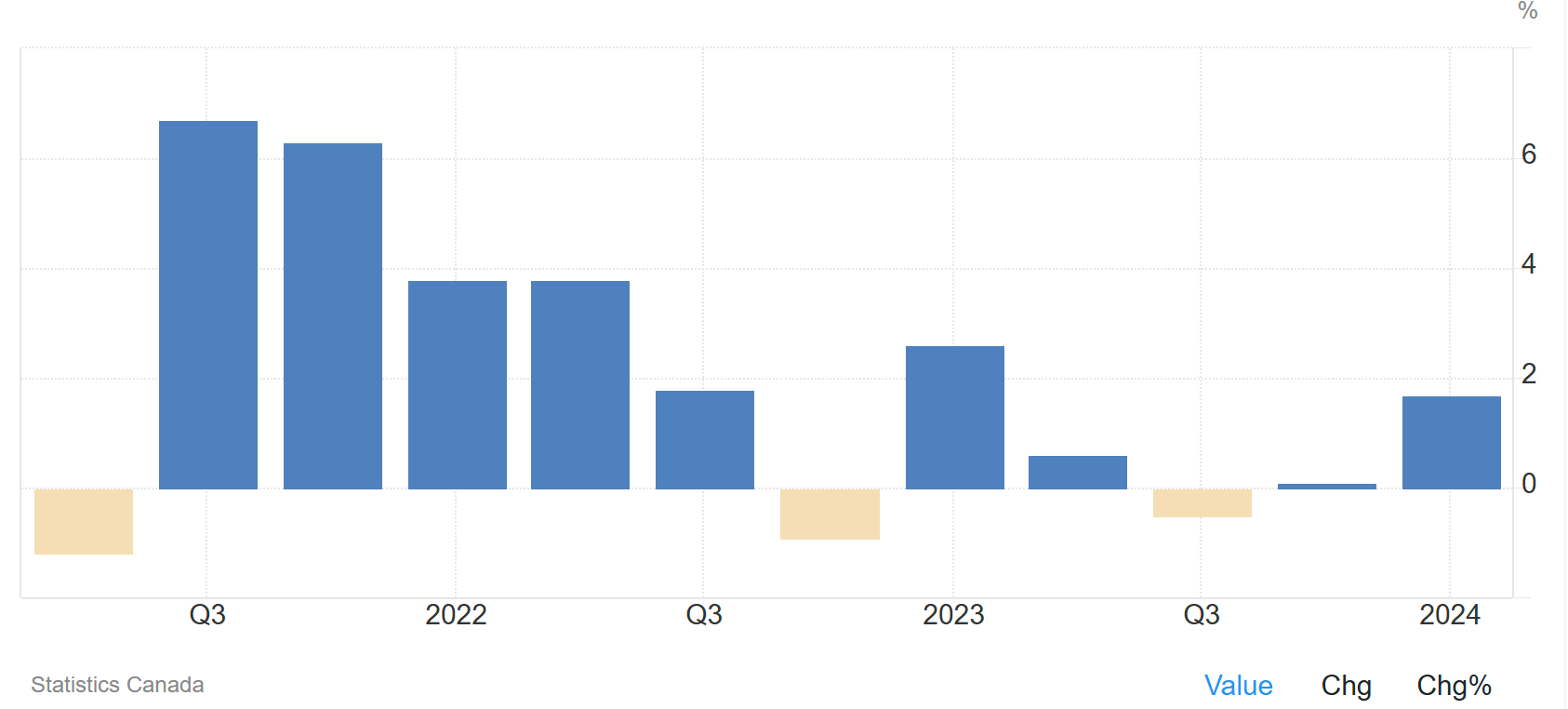

The Canadian GDP expanded by 1.7% in annualized terms in the first quarter of 2024, accelerating from a downwardly revised 0.1% increase in the fourth quarter but coming below market expectations of 2.2% growth.

The annual inflation rate in Canada eased to 2.7% in April of 2024 from 2.9% in the previous month, in line with market expectations, to mark the softest rate of consumer price growth since March 2021. It was consistent with BoC expectations that inflation should remain near 3% in the first half, falling below 2.5% in the second half of the year, maintaining the signal that rate cuts are “getting closer.”

The unemployment rate in Canada was at 6.1% in April of 2024, remaining unchanged from the two-year high from the previous month, and slightly below market expectations of 6.2%.

Stay tuned for more updates next week! As always, if you have any questions or need assistance, feel free to reach out.